The gold standard was a monetary system where the value of a country’s currency was directly linked to the amount of gold holdings it possessed.

The system was widely used by major economies across the world before falling out of favour in the 1970s. The gold standard made for easy currency exchanges as the rates were pegged back to the underlying gold supporting the individual currencies.

As governments sought more flexibility over how to manage their economies, in particular, a desire to increase the amount of money in circulation, countries dropped the gold standard in favour of the fiat money system, where currencies are not backed up by a fixed commodity, in use today.

Which country was first to introduce the gold standard?

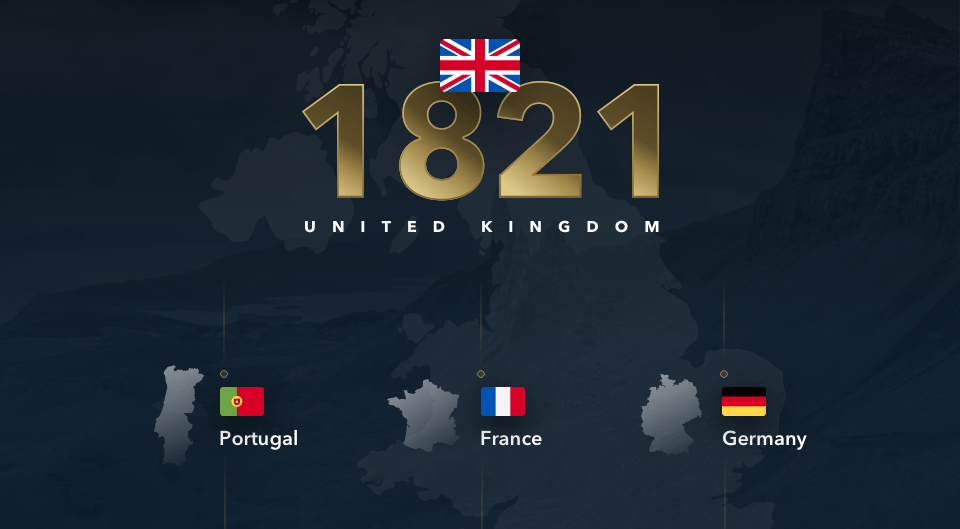

The UK was the first country to formally introduce the gold standard in 1821, but its origins date back to the 18th century as global trade was increasing dramatically. European countries wanted to standardise transactions and with gold already established as a method of exchange, it was the obvious commodity upon which to base this new standardised approach.

Initially, it was just the UK on this new standard, with the country in a strong position to have a gold-backed currency thanks to the amount of metal it had amassed from its colonial empire. Portugal was the next major country to follow in 1854 with France and Germany following suit in the next couple of decades.

During this interim period before the gold standard was more broadly adopted, most countries were on a bimetallic standard where both gold and silver were used to back up the value of the coins in circulation.

The signing of the Gold Standard Act in 1900 by President William McKinley saw the US officially join the Europeans and establish gold as the sole metal (rather than silver) for redeeming paper currencies. It set the value of gold at $20.67 an ounce and valued the dollar at 25.8 grains of gold. By the start of the 20th century, nearly all countries were on a Gold Standard.

For years, the gold standard was successful in providing a way for countries to keep their exchange rates stable and encourage the growth of international trade. It also made trading far less cumbersome with people only needing to carry paper and coins rather than the much denser gold that preceded them.

Why did the gold standard fall?

The outbreak of the First World War saw European countries and the US suspend the Gold Standard as the governments wanted the financial freedom to pay their escalating war bills. Although the standard was readopted at the end of the war, the ultimate breakdown of the system can be traced back to this suspension as from that point on governments were attracted by the financial liberation permitted by cutting the physical tie to gold.

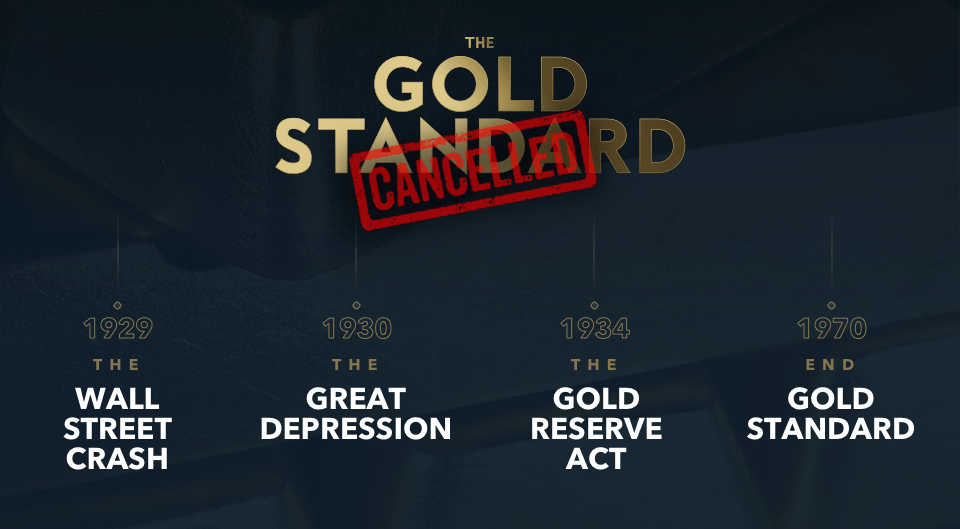

The Wall Street Crash of 1929 and the resulting Great Depression of the 1930s sparked a run on gold at the Federal Reserve as desperate Americans sought gold for their dollars. President Franklin D Roosevelt first closed the banks and then ordered all citizens to turn in their gold in exchange for dollars before signing the Gold Reserve Act in 1934, which withdrew gold from circulation and prohibited private ownership without a licence. It also enabled the heavily indebted government to pay its debts in dollars rather than gold and increased the price of gold to $35 an ounce, the first change since the 1900 Gold Standard Act.

Roosevelt’s actions signalled the end of the Gold Standard, with its independence from government interference lost. Currencies did, however, remain pegged to gold and it wasn’t until the 1970s that the direct relationship was ended under President Richard Nixon as he tried to stave off stagflation.

This era was marked by the rise of the Soviet Union and its vast oil reserves posed a threat to the US’s supremacy. With oil priced in US dollars, the Soviet Union was accumulating vast reserves of dollars from the sale of this key commodity and depositing them in European banks. The rising levels of US dollars overseas coupled with escalating inflation left the US unable to cover all the redemptions on its gold.

Nixon reacted in 1971 by no longer allowing foreign governments to exchange their dollars for gold, effectively sounding the death knell to the gold standard. The dollar was decoupled from gold altogether in 1976.

What would happen if we returned to the gold standard?

After the abolishment of the gold standard, all money printed lacked tangible value, leading to a huge amount of fiat money being printed with no tangible backing. This has led to a devaluation of the dollar and a correlated increase in public debt; creating the modern banking system we have today.

Kinesis has devised a unique solution by reintroducing a currency (KAU) which is based 1:1 on allocated gold and eliminates the need for a central bank by using blockchain technology. This currency provides people with the freedom to transact, beyond the control of financial institutions.

This revolutionary technology provides a return to a sustainable monetary system based on physical assets, with full control and trust, placed back in the hands of the people who own it. A solution fit for the needs of a modern-day economy that draws on a history dating back more than 200 years.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.