April 2022 – A Look Ahead

Developments in Ukraine will remain a key driver of markets in April after a month as dramatic and disconcerting as March. While the fact both sides are engaging in peace talks has to be a good sign, there remains a general uneasiness about Russia’s willingness to stay true to any agreement that may be brokered.

At the time of writing, Russia was set to move its troops away from the Ukrainian capital of Kyiv, where they have struggled to make much headway in the face of fierce Ukrainian resistance, and redeploy them in the Donbas region. Russian units are “not withdrawing but repositioning,” as NATO Secretary-General Jens Stoltenberg described it.

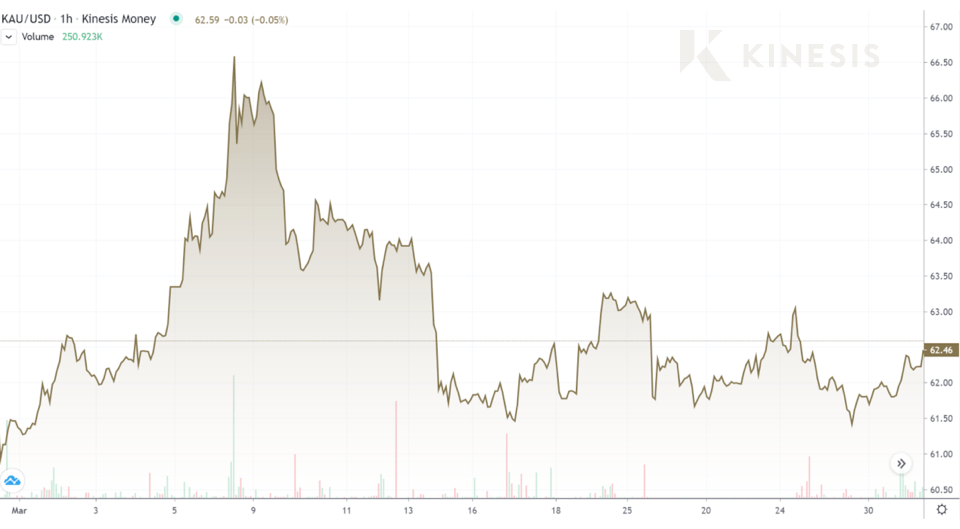

While the conflict continues to rage, both gold and silver are set to be supported by safe-haven demand. However, with the bulk of the fear trading now priced in, it will take a severe escalation in the violence or the scope of the conflict, perhaps with more countries dragged in, to increase this existing source of demand. On the flip side, any sign of progress in peace talks will see gold and silver come under pressure.

Central Banks Take Action

The other main driver in April will be the actions of central banks.

Any additional increases in interest rates will reduce the appeal of gold and silver for those investors preferring a dividend or yield-bearing asset instead.

Inflation figures will also be closely watched to see if there is any sign of the rising costs of living easing. Prior to the conflict in Ukraine, the expectation was that inflation would peak in April but that now seems overly optimistic.

Of course, inflation isn’t necessarily all doom and gloom for gold and silver as while central banks hiking rates in reaction is typically a drag for the precious metals, gold and silver are both considered good hedges against inflation as assets that have retained their buying power over centuries.

Will Gold & Silver Break Close Correlation?

A key development to look out for in April is signs of gold and silver breaking out of their close correlation. While gold looks to have more headwinds than tailwinds to push its price, silver’s more industrial appeal provides it with strong fundamental support, outside of purely geopolitical and macroeconomic factors.

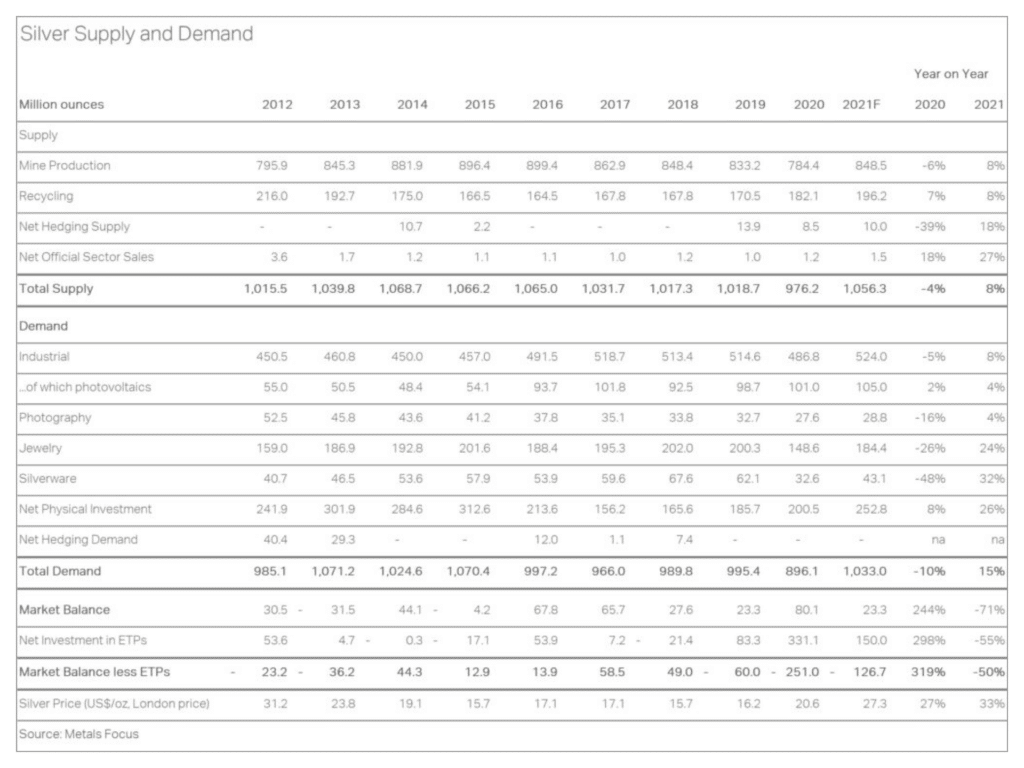

Indeed the Silver Institute is forecasting demand for the metal to reach a new record high this year at 1.112 billion ounces. A major source of this burgeoning demand comes from the solar sector, something that is only likely to gain pace as European countries seek to reduce their exposure to Russian fossil fuels.

“The outlook for silver’s use in the photovoltaic (PV) industry remains bright,” the Silver Institute said. “Government commitments to carbon neutrality have resulted in a rapid expansion of green energy projects. As a result, even with ongoing efforts to reduce silver loadings, record PV installations are expected to lift silver demand in this segment to an all-time high in 2022.”

Silver Supply & Demand

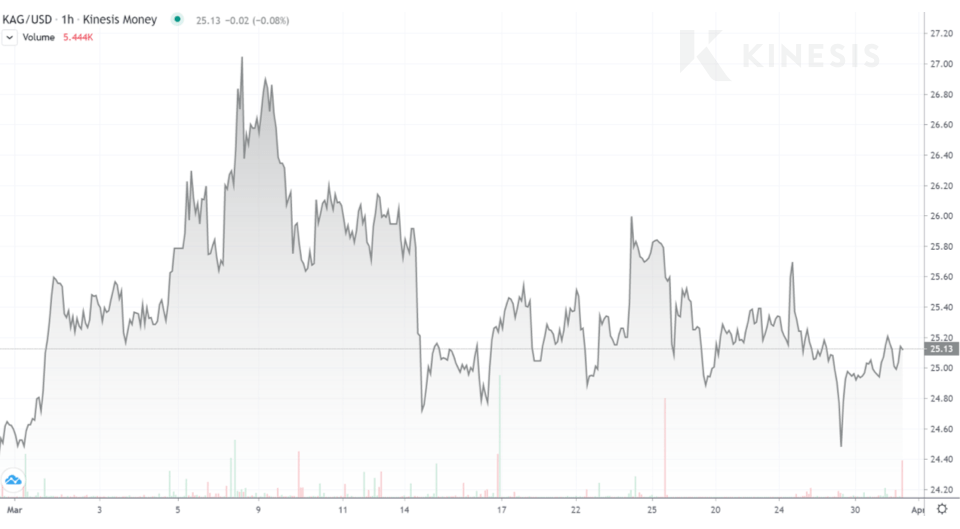

So while gold can be expected to trade either side of $1,900 an ounce in April, silver has the scope to break out higher. Already the strength of investor support has been shown by how quickly the price has recovered back above $25 an ounce on the five recent occasions it has dipped below that threshold. With $25 as strong support, silver can look upward with the potential to once again test levels not seen since the short-squeeze of 2021.

Macros & Markets

March has been dominated by the dreadful events in Ukraine following Russia’s invasion at the end of February. For the first time since the end of World War II, there is an armed conflict in Europe, resulting in the death of thousands of civilians and soldiers with millions of Ukrainians forced to flee their country and seek refuge elsewhere. Our thoughts and sympathies are with all those people caught up in this war.

While our primary concern is with the human suffering caused by the conflict, there is inevitably an economic impact too. In the days and weeks immediately following Russian troops crossing the Ukrainian border, equity markets tumbled with the S&P 500 Index falling to its lowest since June 2021 while the FTSE-100 Index slumped to a five-month low as traders and investors sold out of risk assets in favour of safe havens, including gold and silver.

This rush to gold saw its price top $2,000 an ounce for the first time since August 2020 and went close to challenging its all-time record high before topping out just above $2,050 an ounce. Silver also surged close to $27 an ounce, its highest since last year’s well-documented short squeeze.

The war in Ukraine has also exacerbated an already highly inflationary environment with Russia and Ukraine’s vast supplies of a host of grains, metals and energy likely to be highly constrained for a number of months. In particular, European countries are now rushing to wean themselves off Russian oil and gas as soon as possible with this sudden reduction in available supply from the world’s second-largest oil producer pushing the price of Brent crude close to $130 a barrel.

Rate Hikes

In response to inflation levels at multi-decade highs, central banks across the world are now expected to implement a series of interest rate hikes over the course of this year. Already the Bank of England and the Federal Reserve have raised rates with the European Central Bank expected to follow shortly.

This might be a headwind for gold and silver, as these non-yield-bearing assets are less attractive in an environment of rising interest rates.

However, another implication of Russia’s invasion of Ukraine has been the collapse of the value of the rouble in the face of a series of ever-broader economic sanctions being imposed on Russia and its leading figures. The appeal of gold as an inflation hedge is growing, especially for investors holding roubles and other more volatile currencies, who want to protect themselves from their devaluation and volatility.

Russia’s Gold Reserves

Russia has long since viewed the hegemony over the US Dollar as the currency of the world with disdain and has been building up its gold reserves considerably in recent years. The country now has the fifth largest gold holdings in the world with just under 2,300 tons, according to the latest figures from the World Gold Council.

However, this strategy of bolstering its gold reserves to reduce Russia’s dependency on the US Dollar in the event of a crisis such as the self-inflicted one the country now finds itself in has floundered after the US Treasury banned its citizens and institutions from engaging with any gold-related activity with Russia, with the UK swiftly following suit.

Russia’s gold and silver refiners had already found themselves banned from the LBMA’s Good Delivery list meaning any new bars they produce cannot be sold on London’s bullion market nor in the US after a similar suspension by the CME Group.

Inside Russia, the collapse of the rouble saw citizens rush to buy gold in such volume that the country’s central bank was forced to halt its purchases from local banks. Although the central bank resumed activities before the end of the month, it will now pay a fixed price of 5,000 roubles per gram between March 28 and June 30, considerably below where the market is currently pricing.

Find out more about what Kinesis has to offer

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.