Gold coins are an attractive way for investors to store wealth and also build a collection of coins from around the world and from different time periods. While at the lower end of the spectrum, the gold coins are simply worth the price of their underlying weight, some of the rarest or particularly sought-after ones have sold for millions of dollars.

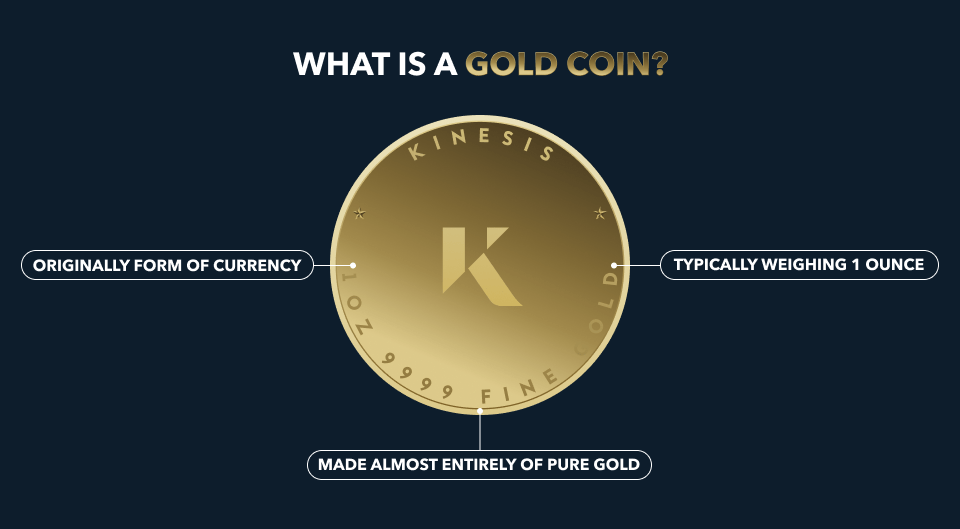

What is a gold coin?

Simply put, a gold coin is a coin made almost entirely of gold. Official government-authorised mints, such as The Royal Mint in the UK, the United States Mint or The Royal Canadian Mint, produce coins, typically weighing 1 ounce, for collectors to purchase. While gold coins originally were a form of currency, these days the coins are for investment purposes with the coins minted having highly decorative designs on them.

Kinesis Money recently launched its own bullion collection, which includes the 1-ounce Kinesis Ma’at gold coin. This investment-grade quality coin, with a minimum fineness of 9999 depicts the Egyptian goddess Ma’at on the obverse as a representation of Kinesis’ overarching values of order, truth, harmony, and justice. Her kneeling posture with a wingspan encircling the curvature of the coin represents her mythological regulation of the stars and the cosmos.

Are gold coins better than bars?

Both gold coins and gold bars are good ways for an investor to store wealth with the choice between the two determined more by the amount of money an individual has available to spend as well as what they want to do with their gold collection.

With gold coins typically only weighing 1 ounce, they are easy to store within an individual’s home with the high decorative quality of the coins making them ideal for a collector to amass a variety of coins from mints around the world.

Gold bars have a much wider range of weights, starting as low as one gram and building up to 12.5 kilograms, although for most retail investors the largest size is 1 kilogram. With a gold price of about $2,000 an ounce, a 1-ounce gold coin offers a more attractive entry point for an investor versus a 1-kilogram bar that costs in excess of $50,000.

Bars typically have more simple designs on them than coins and are more suitable for an investor seeking to store value rather than to regularly view their collection. Kinesis also offers gold bars via its bullion store, ranging in size from 1 gram to 100 grams that depict a statue of Themis, the ancient Greek goddess of justice. Investors can also purchase 1 kilogram gold bars via the Kinesis Mint.

Potential investors should also consider the tax benefits of buying gold coins. In the UK for example, coins from government-authorised mints are exempt from VAT and Capital Gains tax.

The most valuable gold coins today

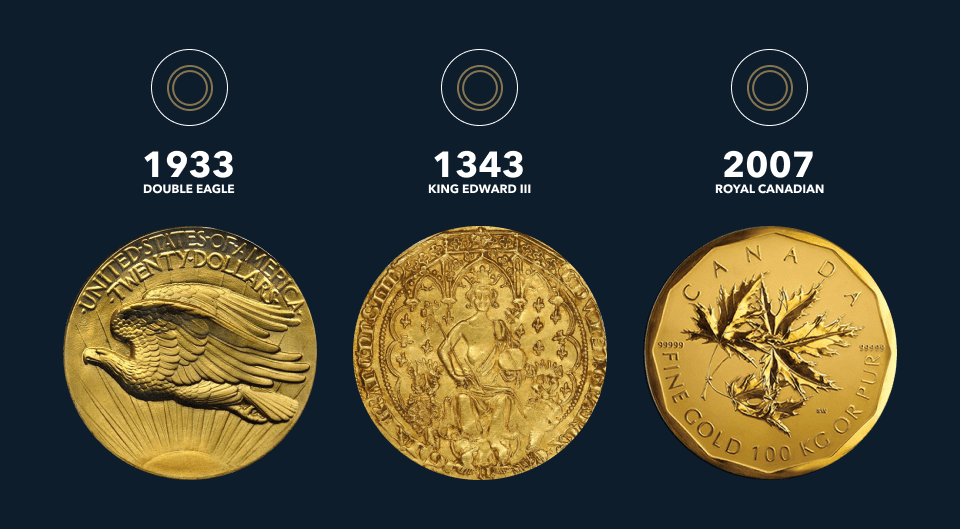

While most coins typically trade at a small premium to the underlying weight of the coin itself, some particularly rare coins that capture collectors’ imagination can sell for millions of dollars. In 1933, the US President Franklin Roosevelt issued an executive order that ceased production of new gold coins and required citizens to return all gold-backed investments back to the Federal Reserve to be melted down.

A few coins managed to escape the clutches of this highly controversial Presidential act with one 1933 Double Eagle selling at auction for almost $19 million in 2021. Other notable coins include ones dating back to 1343 and the reign of King Edward III, with one recently found by metal detectorists in Norfolk in the UK. More recently, the Royal Canadian Mint produced six coins in 2007 weighing 100 kilograms each that had a value at the time of $1 million and are now valued at four times that.

How to avoid buying fraudulent gold coins

Given the high sums involved in gold coins, there sadly remains sufficient incentive for forgeries and fraudulent gold coins to be made and sold. Instructing a specialist third-party expert to grade a coin can help avoid the pitfall of buying one of these fakes or overpaying.

By buying reputable dealers selling coins from international mints, an investor is much less likely to fall victim to a scam. The most popular gold coins are Britannia and Sovereign coins from The Royal Mint as well as the South African Krugerrand, Canadian Maple, American Eagle and the Chinese Gold Panda.

Bought from the right sources, gold coins offer investors a way to store wealth as well as the potential for that collection to appreciate over time while buying into a slice of history.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.