The collapse of three sizeable US banks in the space of a few weeks sent shudders through the markets and the broader investment community earlier in the year and sparked a rush to the ultimate safe haven asset, gold.

This pushed the precious metal’s price up above $2,000 an ounce and close to its highest-ever level. But why was gold so favoured and what can gold’s performances during previous crises tell us about the metal’s role the next time stock markets face turbulent times?

Defining Safe Haven Investments & the Current State of the US Banking Industry

Gold is regularly cited as a safe haven but what does that mean and what other assets fit into this bracket?

Safe haven investments are asset classes that investors typically favour during periods of economic uncertainty or amid fears of a stock market collapse. They are low-risk assets that either have a fixed return, such as bonds or are inversely correlated to stock market performance and can therefore be relied upon to hold their price while equities are falling.

Haven assets were in high demand during the peak of the US banking crisis in March and April this year when SVB, Signature and First Republic all collapsed. While the situation looks to have stabilised, market confidence has remained very fragile ever since, as shown by Moody’s recent cut to the credit rating of 10 small and midsize US banks. This has kept gold well supported with the precious metal still trading comfortably above $1,900 an ounce, a threshold it has only traded above a handful of times in its long trading history.

Historical Performance of Gold as a Safe Haven Investment

While the primary cause of this year’s turbulence was concerns over the health of the banks in the world’s largest economy, there have been numerous previous crises sparked by a range of macroeconomic and geopolitical factors. In nearly all of those previous crises, gold has performed well.

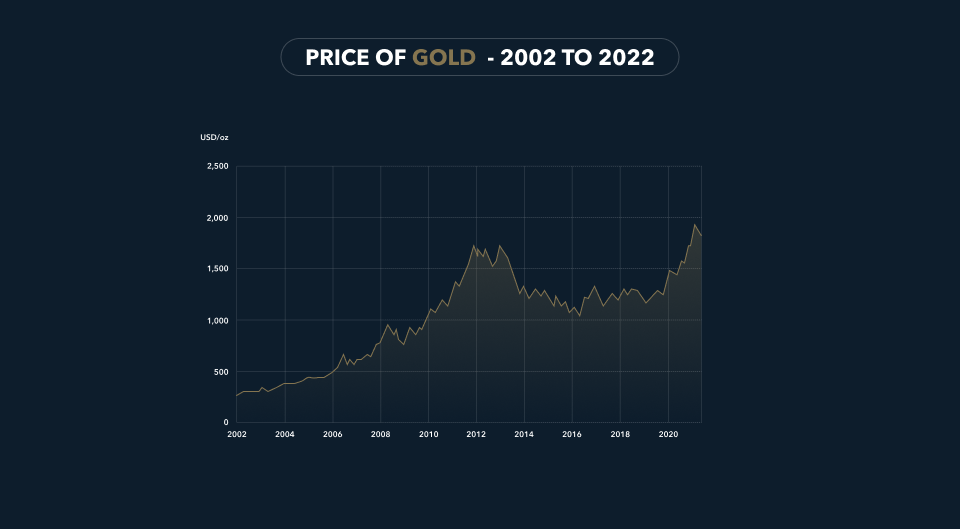

The coronavirus pandemic saw a surge in demand for gold with the price surging to an all-time high in July 2020 with the global economy in lockdown. Similarly, the financial crisis that followed the failure of Lehman Brothers in 2007 sparked a long run of strong performance for gold with the metal doubling in price between 2007 and 2011.

Indeed when the S&P 500 Index, which tracks the performance of 500 of the biggest US companies, on five out of the last six occasions when it has dropped by more than 20% and entered what is known as a “bear market”, gold made gains, highlighting its inverse correlation to equities.

Comparison to Other Safe Haven Assets

The element of gold that made it particularly favoured during the recent banking crisis was the lack of counterparty risk the metal offered. At a time when depositors in the affected banks were worried about how much of the money they held in savings accounts they would get back, the ability for gold to be held in a safety deposit box away from a bank’s balance sheet proved particularly attractive.

With gold recognised and traded around the world, it is an easy asset to cash in at times of personal financial crisis or to cover losses on other investments.

Gold’s main competitor as a haven asset is government bonds, particularly those offered by the countries considered most stable, such as US Treasuries. Bonds have the added attraction of paying a fixed dividend or yield, providing a return to investors. This yield appeal has gained prominence during the last year or so when the Federal Reserve and other central banks around the world have embarked on a series of interest rate hikes to try and curb stubbornly high inflation.

The return on fixed-interest bonds has climbed as a result and made physical gold, which doesn’t offer a yield, less attractive. Yet the fact that gold has been able to continue trading at such elevated levels in the face of interest rates now in excess of 5% highlights how fragile confidence in markets remains following the US banking crisis.

Kinesis gold KAU has come to the fore during this period of market uncertainty and rising interest rates with the gold-backed currency offering holders the best of both worlds: the safety of an asset backed on a 1:1 basis with an equivalent amount of gold, securely held in approved vaults. The gold KAU token also brings with it the flexibility and utility of a currency that can be spent on everyday transactions that generate a monthly yield proportional to the user’s spending activity.

Current Economic Climate and Outlook for Gold

The current economic climate remains highly uncertain with the majority of investors still expecting a recession in the US, the world’s largest economy, before the end of 2024. This lingering concern over the true health of the global economy comes despite the positive data reported, showing resilience in the face of first high inflation and the surging interest rates implemented. This is keeping gold well-supported.

However, with interest rates now above 5% and the prospect of still more hikes to come, this presents a challenging macroeconomic environment for gold, with its lack of physical yield making it less attractive during times of rising rates. As such the two contrasting factors for gold look to be almost balancing one another out with the end result of the price making a slow decline towards $1,900 an ounce over the course of the next month or so, unless a fresh jolt hits markets.

Incorporating Gold into a Diversified Investment Portfolio

Gold has been shown to have a valued role in a diversified investment portfolio as its lack of correlation with other asset classes offers protection at times of negative performance on equities markets. A small proportion of a portfolio dedicated to gold can offer that haven protection a balanced trading approach needs. The Kinesis gold KAU is arguably the best way to hold that gold as it enables them to enjoy a monthly return from their investment along with those same protection benefits.

Want to find out more about gold KAU?

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.