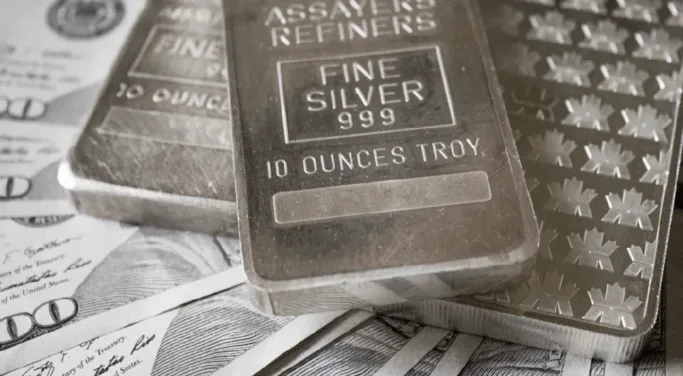

Silver is back above $18 an ounce but remains near the lowest levels in more than two years after the bearish short-term pressures saw the metal start September by dropping into $17 territory.

While silver is largely being driven by the same factor of gold, where a climate of rising interest rates across the world is making non-yield bearing assets like precious metals less attractive, silver is also coming under pressure from a deteriorating economic outlook, particularly in Europe, given the metal’s more industrial exposure than its golden peer.

Russia has increased the stakes in its geopolitical standoff with Europe in the wake of its continued invasion of Ukraine by announcing late on Friday that the Nordstream pipeline, which accounts for the bulk of Europe’s gas flows, will not restart following recent maintenance. This weaponising of energy has placed European economies under further pressure at a time when they are already tackling runaway inflation with the continent now facing the prospect of having to ration energy supplies over the winter.

Against these dual negative backdrops, it is hard to see where silver can get the boost it needs to get it back to the $20 an ounce range it had seemingly stabilised around just a few weeks ago. Yet while the short-term picture remains bearish, the fundamental long-term outlook looks far healthier so for an investor willing to endure some short-term pain, healthy rewards could still be on the horizon.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.