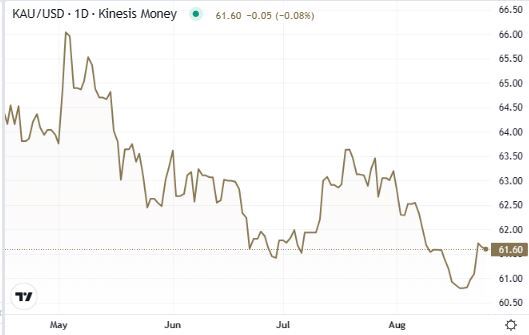

The price of gold remains above $1,900, consolidating the recovery achieved in the first part of the week.

Despite the strength of the greenback and the rebound of bond yields, bullion has shown resilience. Gold has not yet managed to surpass the first resistance zone, placed at $1,930 and the next key level of $1,950, but we should consider the current challenging scenario, with the dollar index future again above 104.

Investor focus shifted to the Jackson Hole Symposium, which started yesterday and will continue today. From the first day of the bankers’ meeting, the markets perceived hawkish remarks. Indeed, Boston Fed President Susan Collins pointed out that it is premature to speak about rate cuts while other rate hikes are still possible. Also, Philadelphia Fed President Patrick Harker had a similar view and explained that the US Central Bank should keep to its restrictive mode to continue fighting inflation.

The central moment of the Symposium will be today, with the speeches of Jerome Powell and Christine Lagarde. Based on our perspective, it’s likely that Powell’s upcoming statement won’t differ significantly from what we observed in the previous FOMC minutes, which was relatively hawkish. Rates could remain steady in September’s meeting, while there is a decent chance of seeing one final rate hike in the following meeting.

Christine Lagarde may be facing a similar situation as she gives her first major speech following the ECB’s decision to raise rates during its last meeting on July 27. Both central banks will calibrate their decisions following the macroeconomic data of the next few weeks. Gold investors should carefully monitor these to understand when the hawkish stance of central banks could end.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.