Many people have asked me for my thoughts on where the prices of gold and silver will end up this year. I know there are some technical analysis-based analysts who think gold could hit $3,000.

I’ve learned over the last 22 years to refrain from forecasting specific price targets. My belief is that we will be quite a bit higher by year-end. That could mean $2500 or $3000 or somewhere in between. Technical analysis in my experience is useless for the precious metals sector because of the heavy amount of official price intervention.

But, that also means that when the price managers lose control, the price will go parabolic.

Knowing when to sell

One of the questions I’ve been asked is about position management, specifically how to know when to sell. It is a great question for which there is no correct answer. The old adage, “pigs are greedy and hogs get slaughtered,” is appropriate because you should never expect to time tops and bottoms perfectly – or even within 10% in either direction.

I have lost money looking for a top and I almost always buy too early. My thoughts on position management are just that and are not to be regarded as investment advice.

The importance of stop-losses

In my view, the precious metals sector is in a bull cycle. In order to lock in gains and not lose sleep over missed upside opportunities, the best strategy is to use stop-losses. You make your own mileage with this but I use stop-losses around 10% below the price for higher dollar stocks. I use a stop-loss maybe 20% below the price for the micro-cap mining stocks that trade under $1 because they tend to be more volatile on a percentage basis. I don’t want to get shaken out of a micro-cap position because of two-way volatility. Don’t forget to move the stop-losses higher as the stock prices move higher.

Beyond that, it is best to be satisfied if you can capture 60-70% of a cyclical bull move (in any stock in any sector, for that matter). It can be hazardous to believe that you can time the top of a bull move in any stock sector. But when the precious metals sector enters a down-cycle, it happens quickly, which is why stop-losses can help manage downside risk exposure.

I recall reading the success formula of a highly regarded professional trader maybe twenty years ago. He emphasized that the investors who achieve the best long-term returns are the ones who focus on, and are satisfied with, capturing the “middle” two-thirds of a bull move. It is impossible to time bottoms and tops and those who claim to have that ability are not being truthful.

Pivoting policies

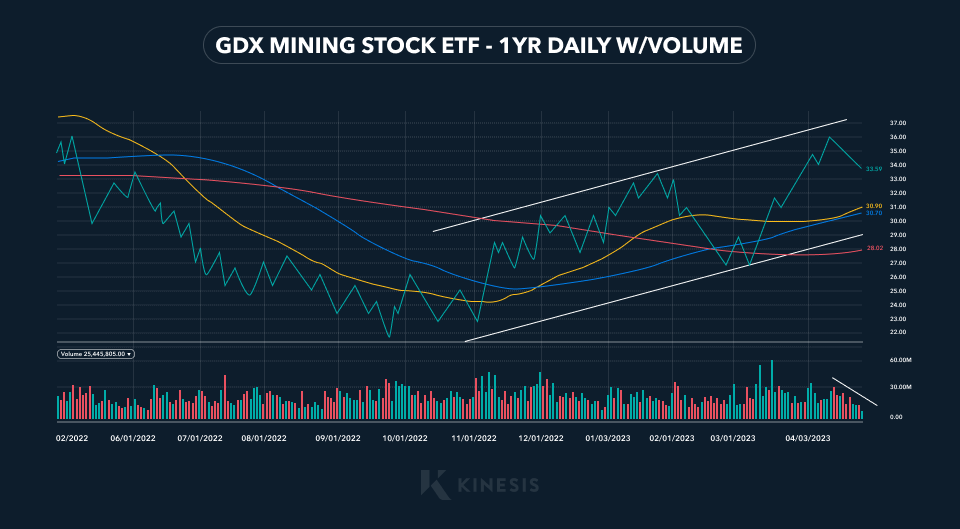

Per the chart above, which is a one-year daily of the GDX EFT, the current move in the precious metals sector technically began at the beginning of Q4 2022. I think the entire market sensed that the Fed will have to pivot from, or at least stop, its monetary tightening policy sometime in 2023. While the stock market has been in rally mode since Q4 2022 started, the precious metals sector – gold, silver and GDX – have decisively outperformed the Dow, S&P 500 and the Nasdaq over that time period through the present.

Technical Analysis

In my view, the precious metals sector could be in for a bull run similar to the bull cycle that lasted from Q4 2008 to mid-2011. That said, it will be a volatile ride. Currently the commonly referenced short-term momentum indicators, like the RSI and the MACD, are showing an extremely overbought technical condition in the precious metals sector.

I have been expecting some type of pullback in the precious metals sector that will set up the next big move higher. In the chart above, GDX became quite extended above the key daily moving averages – 50 DMA (yellow line), 100 DMA (blue line) and 200 DMA (red line).

A pullback typically happens when the sector has “stretched” above the moving averages as it did in early April. Per the chart, a pullback has begun. I highlighted the decline in volume because, when volume falls along with a stock or sector, it often signifies a pullback rather than the start of a downtrend. In my opinion, this will be a “healthy” correction that sets up the next move higher.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.