Several of my subscribers and a couple of junior mining stock executives have asked my opinion on whether or not this rally in the precious metals sector can be sustained.

The simple answer is “I don’t know.”

That said, I’m seeing some “green shoots”. I am watching out for the positive signals and technical indicators that could indicate a durable and sustainable cyclical bull move is underway.

Is the financial situation worse than in 2008?

I strongly believe that the financial and economic systems are set up quite similarly to their condition in 2008, only worse. I believe that the market response to the next full-blown financial system crisis will be much more powerful than last time.

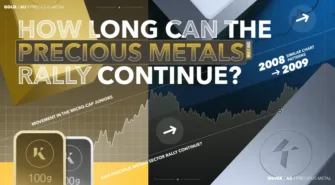

The top panel in the chart above shows the first eleven years of the ongoing secular bull market in precious metals. The bottom panel is the “handle” portion of the massive cup and handle formation in the chart of gold that has gold bugs on the edge of their seat.

Notice that there was a similar chart pattern which formed starting at the beginning of 2008 to July 2009. The move up and out of that pattern took gold to its then-all-time high price.

What the data shows

The current “handle” has been in process for a little over three years.

If the handle breaks to the upside, the duration of this formation relative to the one from the earlier period gives me cause to believe there’s a good probability of a move that will be more significant, on a percentage basis, than the run in gold from late 2008 to late 2011.

Gold is on its fourth attempt to push through $2,100 an ounce and into all-time high territory. It has already hit new all-time highs in several other fiat currencies.

To be sure that the current rally in the precious sector has sustainability, gold must break the $2,100 threshold and soon thereafter move higher from there.

Over the last 22 years, the gold price managers in New York and London have exerted a forceful effort to prevent or delay gold price moves up and over key round numbers.

On mining stocks

What are the mining stocks telling us about the potential for a bull move in the sector?

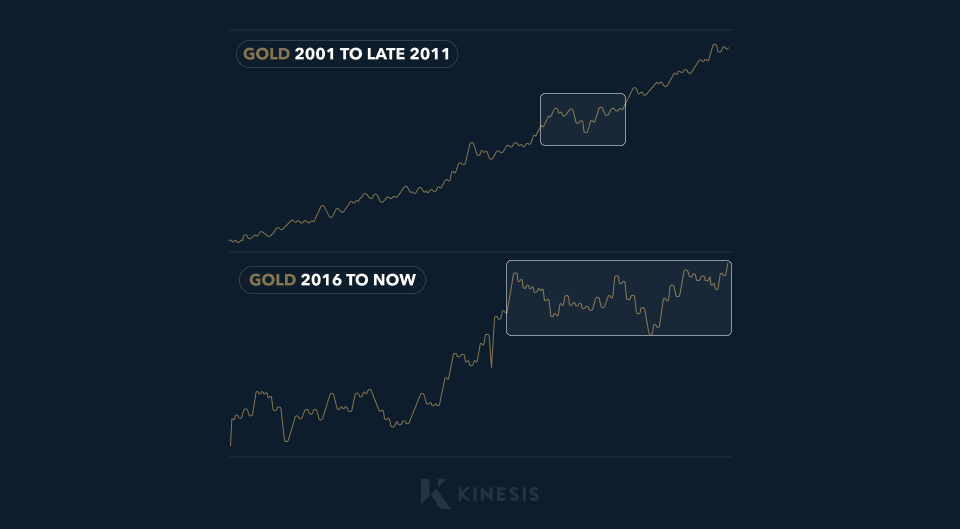

The chart shows the gold price vs the Amex Gold Bugs Index (HUI) from 2001 to the present in the top panel and the S&P 500:HUI ratio in the bottom panel. I’m using the HUI because I wanted to take the chart back to the 2001 start of the precious metals bull market and GLD did not exist until 2006.

The chart shows that not only are the mining stocks cheap relative to the price of gold but also the mining stocks are cheap relative to the general stock market. I believe the SPX: HUI ratio is set up to “correct” lower, with the mining stocks outperforming the rest of the stock market for an indeterminable amount of time.

The mining stocks should also begin to outperform the price of gold and silver. Speaking of silver, poor man’s gold has been underperforming king’s gold since early 2011. If gold launches, it will pull silver along with it. But at some point, if history is a reliable guide, silver will eventually outperform gold. And, ultimately, the mining stocks will outperform both monetary metals.

How to tell when the market has turned bullish

To give me full confidence that a cyclical bull cycle with lasting power is underway, I would like to see the price of silver start to outperform gold. Additionally, I want to see silver move into the high $20s and run into the $30s.

I also want to see the mining stocks begin to outperform both metals. This has started to a small extent but we need to see GDX break into the high 30s and continue higher.

Final thoughts

Many of the junior mining stocks have started to move off of their bottoms. The movement in the micro-cap juniors shows that risk-seeking capital is starting to flow into the precious metals sector.

This is a good sign. However, the directional movement of the mining stocks flows from the price movement in gold and silver. If and when gold can plough through $2,100 and move higher from there, I believe the entire sector will be off to the races.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.