What were the potential implications of the US defaulting on its debt? With the world’s largest economy narrowly avoiding defaulting on its debt, we reflect back on how the US came to be in this position and the implications it has for investors and in particular its impact on the gold and silver markets.

On Saturday 3rd of June, US President Joe Biden announced he would sign into law a new deal to avert the debt ceiling crisis, something he claimed averted economic collapse. This deal suspends the debt ceiling limit until January 2025.

The possibility of the US defaulting – whether it happened or not – has a profound effect on uncertainty in the market. This uncertainty affects the price volatility of markets, including precious metals like gold and silver.

What is a debt ceiling?

Created over 100 years ago, the debt ceiling is designed to limit the amount of money that the US government can borrow for spending. If it reaches the limit, it must find other ways to spend money than simply borrowing.

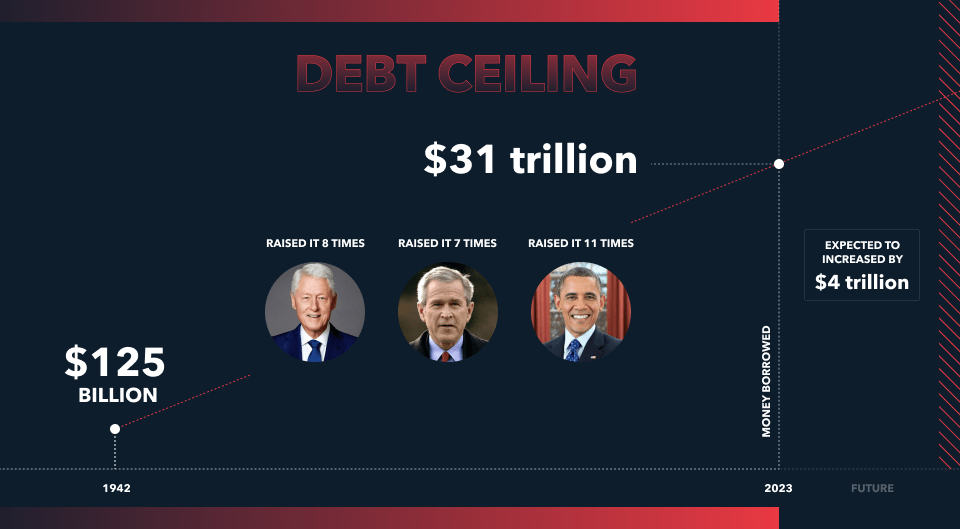

Requests to and actual increases to the debt ceiling are not uncommon, with Bill Clinton raising it eight times, and George W Bush seven. President Obama raised the ceiling eleven times.

Since the 1990s, there have been five “debt ceiling crises” including the one being experienced now.

In 1942, the debt ceiling nearly doubled from $65 billion to $125 billion as a result of the US entering World War II in December of the previous year.

The current debt ceiling is over $31 trillion, with any deal expected to increase this by a further $4 trillion (4000 billion by the US standard).

What are the benefits of a debt ceiling?

If working as intended and not simply being raised repeatedly, the debt ceiling acts as a check and balance on the power of the US government to spend beyond its means.

Another positive is that it enables the government to take a holistic view of the nation’s finances.

What are the negatives of a debt ceiling?

In recent years, the debt ceiling has become a more contentious issue and has even caused governmental shutdowns.

It can also mean that government funds are constantly allocated or reallocated to different projects and departments to prevent impacting the debt ceiling, which can cause temporary delays to important programs.

Also, the fact that the ceiling can so easily be raised suggests an immature approach to fiscal responsibility.

The history of the US debt ceiling

The US debt ceiling as we know it was created as a response to World War I and allowed the US to issue bonds – purchasable debt securities – that many investors have seen as attractive options throughout history.

Predicting the future of the US debt ceiling

The current attempt to raise the debt ceiling is by no means the first, and certainly won’t be the last. Any deal is likely only to finance the government up until the next US General Election in 2024.

Constant raising of the debt ceiling is unsustainable, as is printing more and more new money. In every term (short, medium and long), a more sustainable alternative to increasing the amount of borrowing should be found.

The impact of a US debt ceiling renegotiation on gold and silver prices

As investors seek safe-haven assets in times of economic uncertainty, the agreement of a deal to increase the debt ceiling would prevent – at least in the short term – the defaulting of the US on its debts, returning some confidence to the markets.

It is possible that this return of confidence could see the price of gold and the price of silver negatively impacted, at least in the short term, though it is worth noting both metals have been trading at elevated levels in 2023.

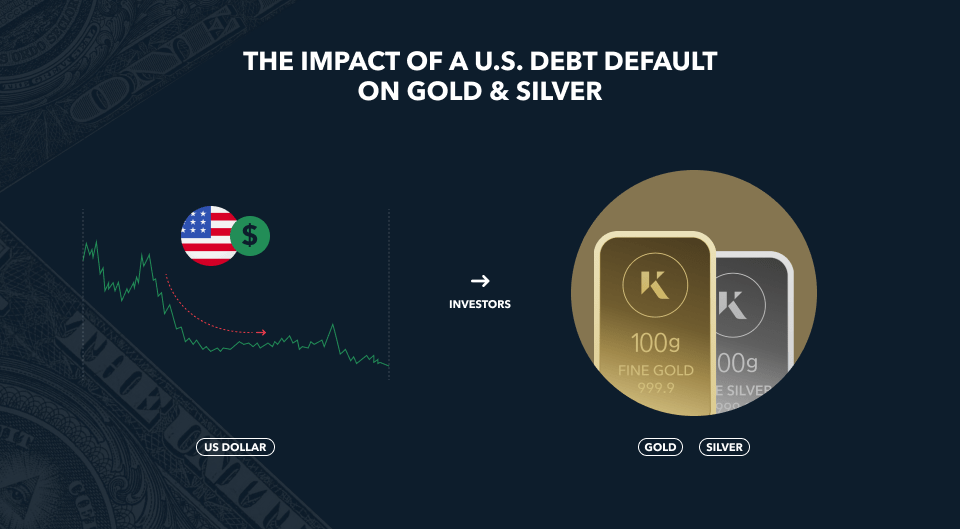

The impact of a US debt default on gold and silver prices

The US defaulting on its debt would cause sharp falls in the value of the dollar, which has historically been linked to both gold and silver – it is likely that investors would flock to them, and this could see their prices jump.

However, it would also be an unmitigated disaster for the financial markets, and it is impossible to say with any certainty how far-reaching and negative the effects could be.

With the US debt ceiling only in operation for a little over 100 years, compared to gold’s millennia-spanning legacy as money, it is likely the history of the US debt ceiling is only just beginning.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.