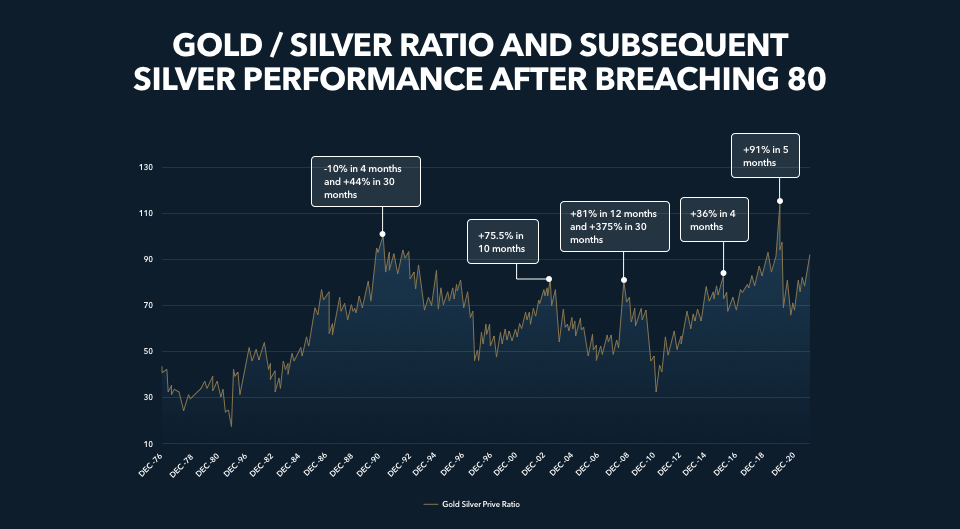

The chart below shows the gold/silver ratio (“GSR”) dating back to December 1974.

Every time the GSR has surpassed 80, it has signalled a bull move coming in the precious metals sector. Here, the chart shows the percentage move higher in the price of silver in the said timeframe:

I was aware that the sector rallied when the GSR reached a relatively high ratio, but I was not aware of the remarkable consistency of that pattern. Usually, when the sector feels the most “helpless” is when an unforeseen event sparks a bullish reversal. This period of time is quite similar to the final few months of the precious metals sector sell-off of 2008. Back then, gold and silver hit a bottom when it felt like the path of least resistance was lower still. They began to move higher in the last week of October and mining stocks followed a week later. The economy, including a crash in the housing market, and the financial system were rapidly falling apart – in a strikingly similar way to the current situation.

If the Federal Reserve flinches – even a little – on its monetary tightening path, there’s potential for an explosive upside move in gold and silver. Even in the absence of a change in direction in the Fed’s monetary policy, the GSR along with the relative long/short positioning in COMEX gold and silver futures by the banks and managed money funds, are signalling the potential for a significant bull move in the precious metals sector.

The shift to a net long position in silver contracts by banks, and a corresponding net short position by hedge funds, since the middle of summer has been well documented. However, the shift by the hedge funds to a rather large net short position in COMEX gold futures has not received as much attention. The hedge fund money that trades momentum swings in the markets appears to be shorting gold futures as the US dollar index rises. The footprints of this pattern can be found in the COT (Commitments of Traders) report data.

I looked at the weekly COT data for 2022. The dollar bottomed in the second quarter of 2022 and began a relentless move higher in response to the Fed’s move to tighten monetary policy. The net long position in hedge fund gold contracts peaked in mid-March and was reduced rapidly into a net short position by mid-July. At the same time, the banks were covering their gross short position, and thereby rapidly reducing their net short positioning.

I believe the COT positioning signal is more powerful when the hedge funds are net short in both metals’ futures. If the dollar loses steam and rolls over, whatever the source for the spark that hits the hedge fund short position “dry tinder” will unleash an avalanche of momentum-chasing, short-covering by the hedge funds. These funds will flip back to being positioned net long. The banks likely will sell futures contracts into the hedge fund buying in an effort to slow down the upside movement in gold and silver.

At the same time as the COMEX shorts scramble to reduce their upside risk exposure to gold and silver positions, I believe there will be an intensified effort to convert fiat currency into physical gold and silver, along with an acceleration in the removal of this metal from bank custodial vaults in London and NYC and into private safe-keeping arrangements. A noticeable reduction in vaulted gold and silver in London and New York has been occurring for several months. I refer to this as a “low-grade gold rush”. At some point, this will transition into a “frenzied gold rush” – similar to that which occurred in 1979.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.