Searches for how to buy gold have recently hit all-time highs. Given the current, post-COVID macroeconomic environment of high inflation and the ongoing cost of living crisis, this is perhaps unsurprising.

As potential and seasoned investors worldwide alike search for a means to hedge against the threat of inflation, many investors are turning their attention to precious metals.

Precious metals like gold and silver not only have thousands of years of history as money, but they’re also enjoying a resurgence thanks to technological innovations like blockchain, and industrial demand for solutions such as electric vehicles and solar panels, in silver’s case.

Gold is money and it always has been

While gold has been used as a currency for thousands of years, savings accounts as we think of them today did not really exist until about the 1800s.

Nearly 200 years later, in 1998, Individual Retirement Accounts (IRAs) in the United States began to invest in precious metals. This was after investing in gold and other precious metals became popular in the US in the 1970s.

Investments in these times were typically made in physical gold: bullion or coins such as the South African Krugerrand, which at one point in the 1980s accounted for around 90% of the gold coin market until it was banned in 1985 by President Reagan.

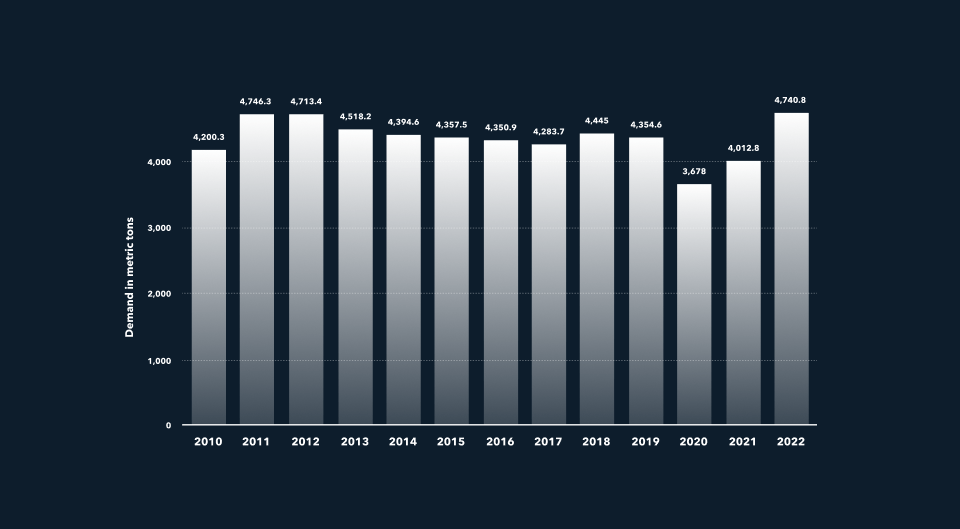

Online gold savings accounts backed by fully allocated physical bullion, such as the offering from Kinesis, are a newer invention and an area that is seeing growth in 2023 as the worldwide demand for gold remains strong.

What is a gold savings account or program?

Central banks across the world typically hold large reserves of gold so that they can store value and pass wealth to new generations of individuals, indeed, central banks around the world have recently been increasing their holdings. These new generations may begin looking into how they might personally invest in gold and benefit from their own savings account or program.

Recently, China made it easier for Chinese citizens to purchase gold through their savings accounts, and this went relatively unreported in Western media.

Elsewhere, however, there are several European, UK, and US providers that offer savings and investment accounts that incorporate precious metals like gold and silver.

These programs allow investors to protect and increase their savings whilst hedging against inflation through holding assets that appreciate in value, have intrinsic value, and are in high demand – something more and more attractive in 2023’s economic climate.

Examples of gold investments, savings accounts and programs

With the breadth of gold investment options, savings accounts and other programs available on the market, let’s explore the most popular avenues in more detail below

Gold savings accounts – the most common of these simply refer to bank accounts that enable the easy purchase or selling of gold as if it were a foreign exchange currency, though it is classed as a commodity. This often roughly equates to a digital representation of physical gold bullion, in the same way that the US dollar used to represent a receipt of gold ownership.

Gold ETFs – since 2004, gold exchange-traded funds (ETFs) have been consistently popular with investors because they remove the need to purchase physical assets whilst still being able to profit from fluctuating prices. We’ve written about Gold ETFs before and how they stack up against digital gold, here.

Digital Gold – asset-backed gold and silver tokens on the blockchain take much of the friction out of investing in physical precious metals like gold, as you don’t need to worry about transport or storage.

Gold mining company stocks – Gold mining companies are profitable businesses, and those who choose to invest in them can benefit indirectly as well as directly from gold production.

Gold derivatives – typically reserved for experienced traders, this option is still open to anyone via online trading platforms, including forwards, futures and options contracts related to the price movements of gold.

How to choose the best gold savings program

There are several considerations to bear in mind when investing and deciding on the most favourable gold savings program.

Trading gold

This must be made as easy as possible and without high fees to purchase and store. Selling should be accessible and without high fees.

Gold spending & utility

It’s important to research whether the gold saving program offers spending via, for instance, a physical or virtual payments card, protecting wealth and savings up until the moment of purchase.

Once precious metals are inside an account, they should be accessible and have a use beyond simply holding for the long term.

Divisibility

Previously, gold was divisible in tonnes, kilograms, ounces and grams.

Trust & Security

There are several different standards for the market recognition and quality of gold, the fineness rating being one of them.

Gold asset ownership

Purchasing gold as an investment on behalf of, for instance, a grandchild may have been unnecessarily time-consuming and complex before the digitisation of assets on the blockchain.

Furthermore, beyond overcoming the problems highlighted above, savvy savers can look for gold savings accounts or programs that create additional value for them through, for instance, yields, cashback, easy buying, selling and swapping of assets.

Enter the blockchain

The blockchain has changed the way hundreds of millions of people around the world invest, and this includes those who invest in precious metals like gold.

Distributed ledger technology is rife with potential and innovation, bringing human financial history not only up to date, but also into the future through the digitisation or “tokenisation” of real-world assets like, for example, an ounce of gold.

Thanks to the transparency and verification offered by the blockchain, digital tokens can be backed by an asset, with audits demonstrating that physical gold is held equal to the amounts of asset-backed tokens in circulation, enabling investors to purchase, sell or trade gold easily on blockchain-powered exchanges. Furthermore, all digital assets should be redeemable for the underlying bullion backing them.

How to buy gold with Kinesis

Once you’ve signed up and verified your Kinesis account, buying asset-backed gold on the blockchain is as easy as:

- Funding your account with fiat or cryptocurrency

- Purchasing KAU on the Kinesis exchange

As soon as you receive your gold, you’ll start accruing your Holder’s Yield monthly payout. Furthermore, you can spend it or trade it, unlocking additional yields.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.