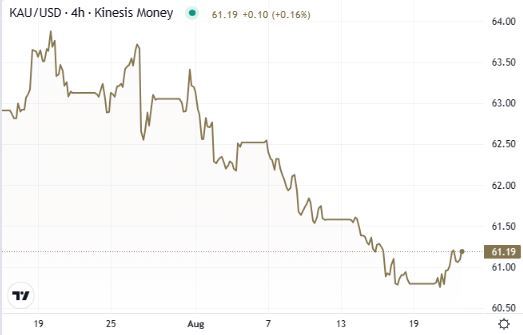

Gold posted only fractional gains in the first part of this week. It rose from $1.890 to $1,900 per ounce, while the price per gram surpassed the $61 mark.

This recovery attempt is a positive signal for the metal as it shows that buyers are returning to a more active mode, but we cannot yet consider the current movement to be a proper inversion. What is missing is a major catalyst with the strength to trigger a rise big enough to offset the decline of the last few weeks.

On the macroeconomic agenda later today is the release of the U.S. services PMI for August and New Homes Sales, while tomorrow the attention will shift towards the Initial Jobless Claims. However, the most significant event for most investors is the Jackson Hole Symposium and the speech of the chairman of the Fed on Friday.

Although it is unlikely that Jerome Powell will talk in too much detail about the Fed’s monetary policy plans for the rest of the year, investors will try to find in his words any clues on whether the US central bank is likely to hike interest rates one more time late this year. Any potential dovish or bullish hints in his speech are likely to move markets one way or the other. From a technical point of view, the first key level is placed at $1,900.

A hold above this level will represent a first positive signal. More significant resistances, or areas which could curb bullish impulses, are $1,930 and $1,950. On the other hand, the first support is $1,885, the low reached last week. A decline below this threshold, in conjunction with a stronger dollar, could make a further fall more likely. The price could find minor support at $1,855, while a stronger support zone is placed near the low of March 2023 at $1,805/1,810.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.