At the close of January, gold was up 5%, silver was down marginally and mining stocks were up 11% (according to the Van Eck Gold Miners ETF).

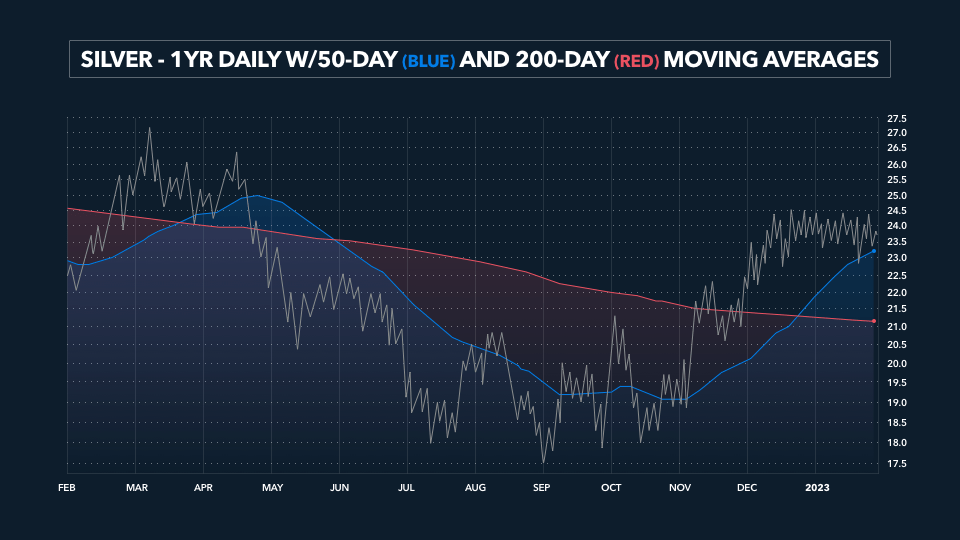

While silver was trading below its highs last year, the metal has climbed 32% since the beginning of September. From a technical standpoint, using the RSI and MACD indicators, silver has become technically “overbought”.

The lateral movement since mid-December is therefore a healthy consolidation of the big move higher in the last four months of 2022. In my opinion, silver’s trading action suggests it is setting up the next big move, which I believe will break higher.

Considering mining stocks, the large-cap and mid-cap producers for the most part have outperformed the smaller-cap and micro-cap juniors. While some of the micro-caps have had some decent moves, most have not responded – or have barely responded – to the move in the sector.

During the eight-month and six-month run-ups in 2016 and 2020 respectively, the micro-caps went parabolic. With hindsight, I would suggest that trading behaviour was the signal that the sector rallies back then would be short-lived. The fact that the micro-caps are not going parabolic this time could be an indicator that the current bull cycle will be sustained for a longer period of time – like late 2005 to March 2008 and November 2008 to mid-2011.

Something that has gone unnoticed is the fact that the price of gold in January 2023 was almost back to similar levels seen when the Fed first hiked the Fed funds rate (FFR) in mid-March 2022. At that time, the price of gold was trading at $1,950 when the Fed pushed the FFR up to a target range of 25 to 50 basis points.

After dropping to a low of around $1,640, gold has rallied back to over $1,900, just slightly below where it was when the rate-hike cycle began, while the FFR is now at a target range of 4.5%-4.75%. Silver was 4.4% below its price when the Fed began rate hikes compared to the S&P 500 and the Nasdaq, which were down 6.3% and 14.9%, over the same period.

I am expecting a big move higher in the precious metals sector this year, as the Federal Reserve will likely soften its stance later this year. Some other major central banks have already begun to ease their monetary policy. The markets, particularly the precious metals sector, will anticipate this coming shift in Fed policy with a bullish move in advance of the actual event. The move higher in gold during January could be the start of this revaluation, with silver soon to follow gold higher.

Another significant factor that should reprice the precious metals sector higher is a growing shift away from the U.S. dollar by eastern bloc countries, the BRIC consortium and OPEC nations.

At the World Economic Forum in January, the Saudi Arabian Finance Minister said that Saudi Arabia is open to trading in currencies other than the U.S. Dollar. Last March, Saudi officials said that the country would be open to accepting Chinese yuan for oil. This development is quite bullish for the price of gold denominated in dollars, which has lagged behind the price of gold denominated in the other major fiat currencies such as the Euro, Yen, and British Pound.

Based on a strengthening of the fundamental factors that drive the prices for gold and silver – and thereby the mining stocks – I believe we are seeing the onset of a bull cycle for the precious sector. As such, I expect that the prices of gold and silver will be considerably higher by the end of the year.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.