What is Technical Analysis?

In the financial environment, technical analysis is a methodology which studies stocks, commodities, bonds, and other listed assets, trying to predict their future movements.

The basis of technical analysis involves studying charts, prices and volumes, using graphical and statistical methods.

Technical analysts try to determine trends and chart patterns using many indicators and oscillators, which can generate buy or sell signals. They also look to determine support and resistance zones, which are price areas where there are significant volumes.

Overall, the target is understanding the trends of an asset. Since history tends to repeat itself, statistically speaking, the prices will also tend to move as has already happened in similar situations in the past. As we will see in this article, technical analysis is often used for studying the price of gold and its trends.

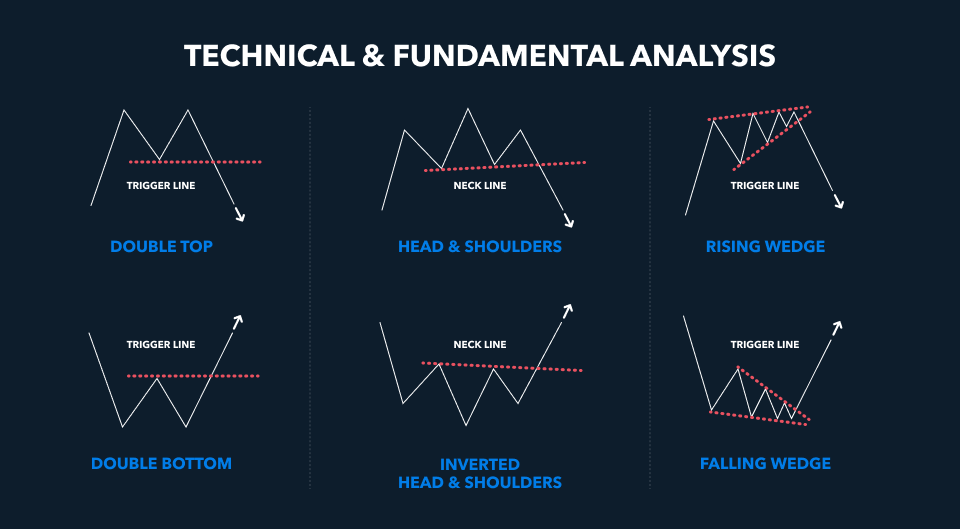

Technical & Fundamental Analysis

Technical analysis is one of the most popular ways to study the price of financial assets along with fundamental analysis. However there is a clear difference between these two methodologies.

Indeed, in contrast with technical analysis, the fundamental methods are based on the study of financial figures. Fundamental analysts mostly use balance sheets, income statements and expected earnings for a company (but this of course cannot be applied for gold). For bullion, it could take in demand forecasts from industry and jewellery, but it cannot understand market sentiment, which often dominates gold price movements.

In short, fundamental analysis focuses on financial data instead of historical patterns and market trends, which are the key points of technical analysis.

Is Technical Analysis Suitable for Gold?

Does technical analysis work on Gold? The answer is: of course yes. Many traders use technical analysis on a daily basis on gold, silver and other commodities. Technical analysis could be applied to every listed asset, including gold. It can help traders to understand the trends and price direction of the yellow metal.

Gold is neither a cash-generating asset nor a commodity. It means that gold cannot be valued like assets which generate cash flows. Gold investing is more a pricing game than a value game. Therefore technical analysis is ideal for gold, as its price is affected by market sentiment. Moreover, it can be used on gold with different timeframes: from short-term analysis to multi-day trading.

How to use Technical Analysis on Gold?

Investors should, first of all, try to determine the major trends to understand the direction of prices. After this, the next step is to identify the key price level: support and resistance.

When the price approaches a support zone, we could expect a significant increase in buying which would therefore be supportive of the price. Vice versa, a resistance zone would be difficult to be overtaken with many investors having placed their sell orders there.

If the support (or resistance) is strong enough to curb the bearish (or bullish) pressure, the analysed asset could face a potential reversal in its price direction. Oppositely, a clear breakout above these levels could be seen as a strong directional signal, opening space for further directional movements. In summary, a break-up of a resistance level is a positive signal, while when the price sinks below a support zone, it is likely to spark further.

Apart from these elements, gold traders have on their trading platforms several technical indicators and oscillators. Those are used in conjunction with trends, support and resistance levels to generate trading signals.

How to Identify the Trends

One of the most important jobs of a technical analyst is identifying market trends.

A trend could be identified using trendlines, which are lines that traders draw connecting a series of prices. These trendlines show the main tendency of prices of gold or other assets. The trend could be positive, negative, or lateral.

A large number of traders prefer to trade in the same direction of the trend, hence the phrase “the trend is your friend”. In other words, the trend followers buy in a positive trend, and they sell when the trend is bearish. If gold is in an upward trend, they buy (or increase) their position on bullion. Vice versa they tend to reduce the exposure when the gold price is declining.

But not everybody is a trend follower. Indeed, a different approach to the markets is used by the contrarians: they seek to find a reversal pattern, trading against the trend. They look for corrections in bullish trends and for rebounds in negative phases of the markets.

The Relative Strength Indicator (RSI)

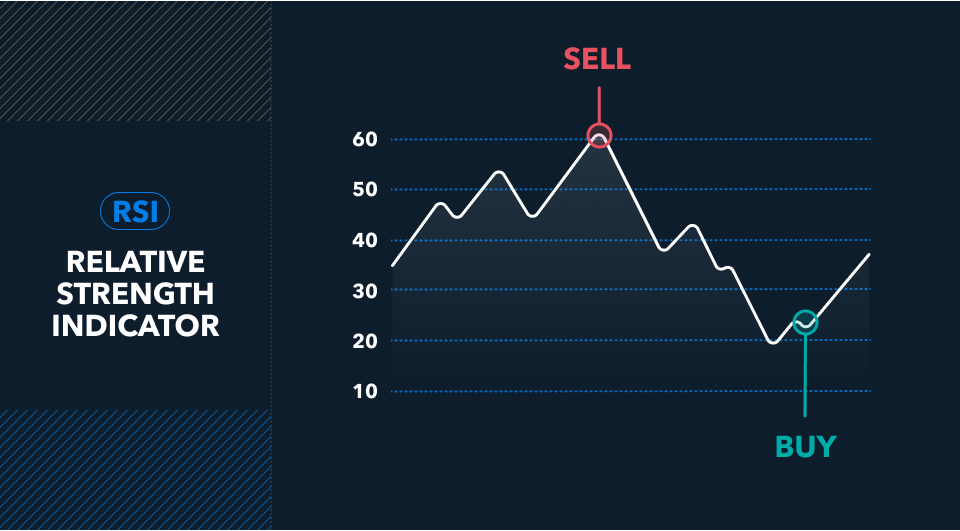

What to watch when trading Gold? One of the most used technical indicators in gold trading is the RSI, or the relative strength indicator. The RSI measures the speed of the recent movement in an asset’s price. It is a momentum indicator which is displayed on a scale of zero to 100.

Traditionally, when the RSI jumps to 70 or above, this indicates an overbought situation. Vice versa, a reading below 30 means that prices could be oversold. In the case of even lower readings (e.g. 15-20), we would have a stronger oversold signal.

A level between 30-70 is the most common, with a slight variation depending on the number of charts used to calculate the indicator.

The Triangle Apex Reversal

Triangles are often used in technical analysis. They can be applied to gold, silver, mining stocks and any other financial assets. A Triangle could be a continuation figure or an inversion pattern, as in the case of a triangle apex reversal pattern.

The key point in a triangle is that we have converging trendlines. Previous highs are generating declining resistance, while the support line – based on previous lows – is rising. In effect, the prices are drawing a sort of triangle. During this phase, the volatility is declining, and the trend is uncertain.

When we approach the end of the triangle, there could be a breakup in the direction of the previous trend, with growing volumes and increasing volatility. In this case, the triangle becomes a powerful continuation pattern. Vice versa, in case of failure, we could have an inversion signal. The Triangle Apex Reversal Pattern denotes high probability of a change in the market trend.

Therefore, the triangle’s Apex Reversal is a pattern often used by technical analysts to detect and predict reversals.

What does a Recent Technical Analysis of Gold Show About the Future Price?

The gold price jumped above the $2,000 an ounce mark in the first part of 2023 for the third time in its history. The technical analysis on gold suggests that the major trend for bullion remains positive, with investors still buying on any price dips.

From a technical point of view, a clear climb above the gold’s record high around $2,070-$2,080 an ounce would open space for new rallies, with a potential target of $2,150-$2,200 while on the downside there are support zones at $1,950 and $1,920.

Currently, the majority of both technical and fundamental analysts agree that the long-term scenario for the gold price appears positive.

Carlo Alberto De Casa is an external Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. His precious metals market commentary has featured in the likes of Forbes, Reuters, CNBC, and Nasdaq.

With a credential background in Economic Finance and International Exchange (MA), his critical analysis of gold and silver markets’ performance is frequently quoted by leading publications, week on week.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.