Trading and investing, as well as the timing of entering and exiting positions, is an art as much as it is a science. It requires an understanding of market dynamics, geopolitical events, and economic factors that influence price movements.

Efficient use of the Moving Average Convergence/Divergence (MACD) indicator can give traders and investors an edge in formulating trading and investing strategies. It is a useful tool to help understand price trends plus it can assist with the timing of entering and exiting short-term trading positions or with the execution of longer-term investment decisions.

The MACD is a momentum indicator that is derived from moving averages. This article explores how to leverage the MACD indicator and its use specifically to trade gold and silver.

How to use the MACD indicator

Before diving into the application of the MACD in precious metals trading, it is essential to grasp the indicator’s fundamental principles:

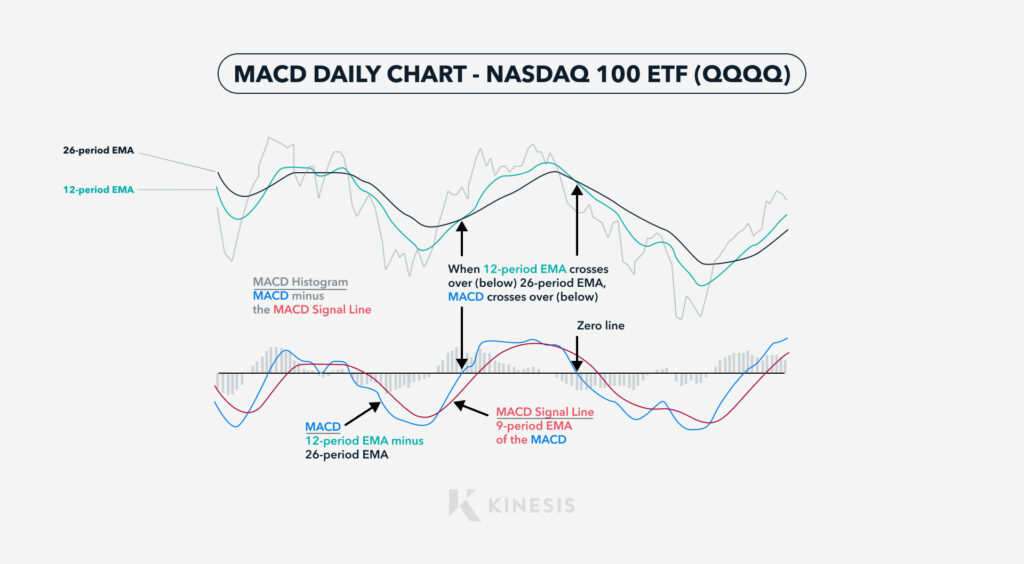

MACD Line (Fast Line): Reflects the difference between short-term (12-period) and long-term (26-period) exponential moving averages, providing insight into short-term momentum shifts.

Signal Line (Slow Line): Represents a 9-period exponential moving average of the MACD line, smoothing out fluctuations and offering a more stable trend indicator.

Histogram: Illustrates the difference between the MACD line and the signal line, visually depicting the convergence or divergence between the two lines and indicating the strength of the prevailing trend.

How to Read the MACD Indicator

The MACD line (blue line) is derived from the differential between the 12-period EMA (extended moving average) and the 26-period EMA. When the MACD line crosses above the Signal from below zero, the indicator has turned bullish. The further below the zero-line, this signal flips to bullish, the stronger the signal. Similarly, the signal flips to bearish when the MACD line crosses below the Signal line from above the zero line. As such the MACD helps identify set-ups that can be used for short-term trades or for entering/exiting longer-term investments.

During periods when the market is range-bound, lacking a distinct trend up or down, the MACD line will oscillate, or “coil,” around the Signal line. Generally, it’s better to avoid using the MACD for timing short-term trades when the market whipssaw. Conversely, when the MACD line crosses over the Signal line to the upside or the downside, the trading signal is stronger when the MACD is diverging positively or negatively from the price action of the security.

The MACD is an efficient trading tool because it combines momentum and trend analysis into one technical indicator. It can be applied to daily, weekly or monthly charts. The standard period configuration is (12,26,9). However, short-term traders should experiment with the settings depending on the objective of the trade. For instance, day and swing traders might want to experiment with the more sensitive (5,35,5) setting for short-term day/swing trades. This setting will generate more frequent trading signals.

Analysing Trends in Gold and Silver Prices with the MACD

Gold, often considered a safe-haven asset, exhibits unique price dynamics influenced by various factors, including economic uncertainty, inflation, and currency movements. Traders can leverage MACD indicators to analyse trends and formulate trading decisions which can be applied to short-term or longer-term strategies for trading and investing in gold.

MACD Crossovers in Gold and Silver Trading

Bullish Signals: Look for buy opportunities when the MACD line crosses above the signal line, signalling potential upward momentum in gold and silver prices.

Bearish Signals: Conversely, consider selling positions when the MACD line crosses below the signal line, indicating possible downward pressure on gold and silver prices.

Divergence Analysis in Gold and Silver Markets

Bullish Divergence: Identify instances where gold prices form lower lows while the MACD histogram forms higher lows. This bullish divergence suggests a potential reversal from a downtrend to an uptrend, signalling buying opportunities.

Bearish Divergence: Conversely, watch for situations where gold prices form higher highs while the MACD histogram forms lower highs. This bearish divergence indicates potential weakness in the ongoing uptrend, signalling caution or potential selling opportunities.

Histogram Patterns and Momentum in Gold and Silver Trading

Increasing Histogram Bars: Rising histogram bars suggest strengthening momentum in the direction of the prevailing trend. Traders may consider entering long positions in gold or silver when histogram bars are increasing, indicating bullish momentum.

Decreasing Histogram Bars: Conversely, declining histogram bars may signal weakening momentum, potentially indicating an impending trend reversal. Traders might consider exiting long positions or even initiating short positions based on diminishing bullish momentum.

Incorporating MACD Analysis into Gold or Silver Trading Strategies

To effectively integrate MACD analysis into trading strategies for gold and silver, traders should consider the following:

Confirmation Signals: Always seek confirmation from other technical indicators, fundamental analysis, or market sentiment before executing trades based solely on MACD signals.

Risk Management: Implement robust risk management techniques, such as setting stop-loss orders and managing position sizes, to protect against adverse market movements.

Market Conditions: Adapt trading strategies based on prevailing market conditions, considering factors such as volatility, economic events, and geopolitical developments that may impact gold prices.

Another trade strategy with the precious metals is gold/silver ratio trading. Please refer to this Kinesis article for a primer on GSR ratio trading.

Navigating The Gold and Silver Markets with the MACD

Traders and investors face the market reality of volatility and uncertainty. The ability to effectively analyse trends and identify trading opportunities is thus invaluable.

By harnessing the power of the Moving Average Convergence/Divergence (MACD) indicator, traders can gain valuable insights into price movements, enabling them to make informed decisions and navigate the complexities of the markets with added confidence. While mastering MACD analysis requires practice and discipline, its integration into gold and silver trading strategies can significantly enhance the probability of success.

Dave Kranzler is a hedge fund manager, precious metals analyst and author. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The opinions expressed in this article, do not purport to reflect the official policy or position of Kinesis.

Read our Editorial Guidelines here.