The spectre of inflation looms large over markets today with the UK’s latest figure coming in at 6.2%, its highest figure in 30 years as the war in Ukraine exacerbated an already inflationary environment by piling extra upward pressure on the price of energy and commodities.

Gold finds itself in a curious position as on the one hand, it is considered a natural hedge against inflation that has retained similar buying power over time. However, the actions of central banks to tackle inflation, such as increasing interest rates, make gold less attractive with interest-bearing assets favoured instead.

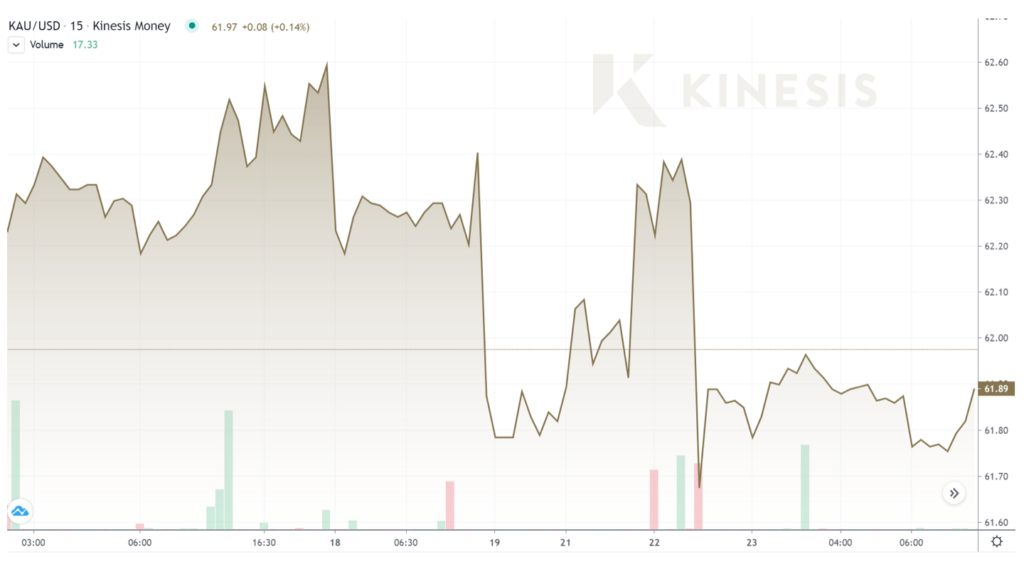

Currently gold is trading up slightly today as are equities, a reminder that simplistic trading rules such as if equities are up, gold will drop don’t always hold sway.

The Federal Reserve has marked out a series of planned interest rate rises throughout the year so gold is likely to face an increasingly less favourable macroeconomic environment. Yet the one factor that could trump all this is a further escalation in the war in Ukraine.

Worryingly, the rhetoric has moved on to threats over whether nuclear weapons will or won’t be used. Given that a few months ago, the exchange of stern words between Russia and its Western counterparts seemed more sabre-rattling with few people expecting Russian soldiers to actually cross the Ukrainian border, the fact that nuclear weapons are even being mentioned is a huge cause for concern.

Given this potential for the nuclear option being deployed, a rush to gold can’t be ruled out but if peace talks prevail then, combined with the hawkish economic policies being adopted by central banks, gold’s likely trajectory will be downward with $1,900 an ounce a key level to see investors’ reaction should it drop there.

Find out more about what Kinesis has to offer

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.