Find out more about cryptocurrency arbitrage trading methods, as well as the potential rewards and barriers.

Visit Kinesis, and you’ll see one Bitcoin priced for 35,904.20 USD. Visit another crypto exchange, and perhaps you’ll see a slight variation of a few cents or dollars. This is no mistake; it’s natural that different markets’ crypto evaluations would vary based on their liquidity and user base, as well as general trading volatility.

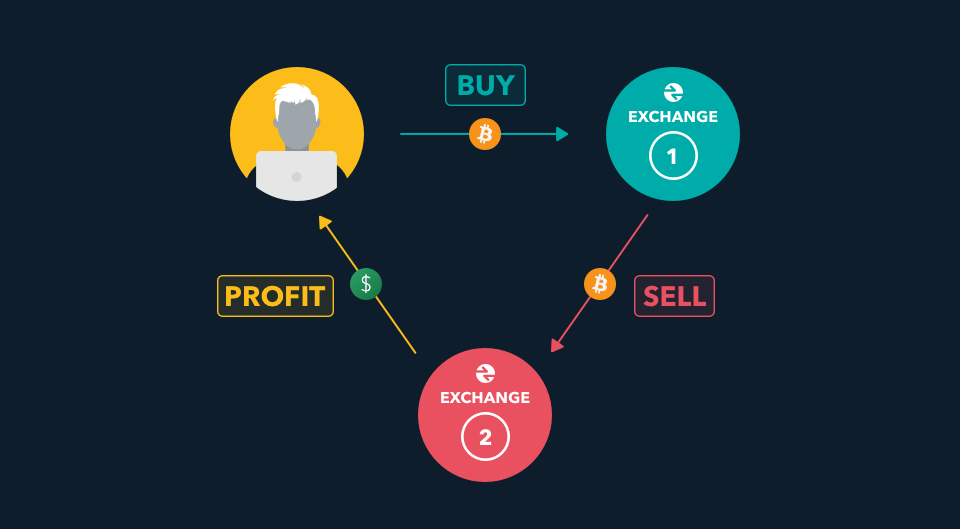

Arbitrage traders capitalise on the value misalignment by buying cryptocurrency at the lower price and selling it for the higher.

How arbitrage trading works

Are you having a hard time wrapping your head around arbitrage? Real-world examples occur all the time. An antique dealer finds a chair for 10.00 USD at a garage sale and sells it for 90.00 USD at an auction. A vendor buys cherries from a rural supplier and charges double at an upscale city market.

Arbitrage traders apply this same philosophy to buying and selling financial assets, ranging from Bitcoin to bonds. However, just because anyone can theoretically arbitrage almost all currencies or financial instruments doesn’t mean there are equal chances of success for all assets.

Arbitrage and risk arbitrage are well-known trading techniques, particularly within traditional markets. Large financial institutions utilise advanced bots to automatically arbitrage stocks and similar securities, minimising opportunities for independent traders to compete.

As a newer commodity that only recently captured large brokerages’ attention, Bitcoin and other decentralized finance present traders with increasing opportunities to retail arbitrage for profit.

Why cryptocurrency is optimal for arbitrage trading

There are 1,100+ crypto exchanges representing diverse levels of sophistication, liquidity, and trustworthiness. The continuous, dramatic fluctuations in crypto prices naturally lead to many of these markets reporting different values for the same currency.

Geography also determines the local value of international commodities. For example, Bitcoin is worth substantially more in South Korean markets. During times of turmoil, Argentinian and Hong Kong exchanges traded Bitcoin at premium rates.

Types of crypto arbitrage trading

There are numerous approaches to arbitrage trading, though common themes and end goals remain the same. While traders will always pursue new ways to leverage market data for revenue, below are some of the most popular cryptocurrency arbitrage techniques.

Simple arbitrage

Also known as “cross-market arbitrage” and “spatial arbitrage,” this straightforward strategy involves buying a cryptocurrency on one exchange and simultaneously selling it on another. Let’s say Kinesis Exchange prices Litecoin at 130.57 USD, but another exchange says it’s worth 130.59 USD. You could buy $10,000 worth of Litecoin on Kinesis Exchange and sell the same amount elsewhere to make an immediate $200 profit.

Triangular arbitrage

As suggested by the name, this type of arbitrage trade involves three different currencies (or two pairs). The goal is to leverage divergences between how different markets appraise and convert other currencies. For example:

- An arbitrage trader buys one Bitcoin for 33,000 USD and then uses this Bitcoin to buy 100,000 Stellar Lumens—each worth 0.34 USD—profiting 1,000 USD.

- An arbitrage trader buys one Bitcoin for 33,000 USD but then sells it immediately for 420,000 ZAR (South African rands) due to regionally-based discrepancies. The resulting profit would be 956 USD.

Convergent arbitrage

This practice involves buying a cryptocurrency when a certain exchange or market undervalues it. The driving assumption is that the asking price will eventually self-correct, letting the trader later sell the currency for a higher value.

Convergent arbitrage can also work in reverse. Let’s say you observe that a crypto exchange prices Bitcoin higher than others. You could short-sell based on the assumption it’s overvalued and will decline.

Take note, not all trading platforms allow short-selling of cryptocurrencies.

Arbitrage is considered a “low-risk” strategy

The likelihood of losing equity while Bitcoin arbitrage trading is low but not absent. What’s more, the dramatic gains-and-losses typical of cryptocurrencies can increase both potential arbitrage risks and rewards. If you’re trading, keep an eye out for the following:

- Having inadequate time to react, for example if a currency pair is in a different time-zone to your own.

- A slippage in exchanges.

- Cryptocurrency exchange site outages.

- Market unpredictability.

Other roadblocks to profit

Transfer delays and upfront capital

Arbitrage traders may grapple with problematic delays caused by transferring currencies between exchanges. An opportunity to profit may last mere seconds, making any delays costly.

In response, arbitrage traders commonly upload multiple currencies to participating exchanges in advance. While this strategy eliminates delays, it requires greater upfront capital and potentially lessens adaptability. After all, it’s common for cryptocurrency exchanges to require you to keep newly invested funds within their platform for multiple days before they’re available for withdrawal.

Trade fees and short-term capital gains

Many platforms charge a fee for each interaction. The individual transactional costs and withdrawal fees may seem minor but can quickly add up to take a sizable chunk of your profits.

Similarly, don’t forget to consider the tax for short-term capital gains. For example, the specific percentage you’ll need to pay in the US depends on your tax bracket and marital status. For instance, a single person who generates $10,000 in short-term profit will pay an estimated 12% in taxes.

Time-consuming research and waiting

We’ve all heard the saying, “time is money.” With cryptocurrency arbitrage, you risk working long hours for little pay-off. Traders must regularly track multiple exchanges and currencies, stay abreast of breaking news, wait with bated breath, and be prepared to seize the opportune moment in an instant.

Traders can supplement some of this legwork with arbitrage trading bots, though this doesn’t entirely eliminate related duties.

Hurdles to joining and interacting with different exchanges

Most reputable exchanges won’t let you instantly join and trade. In fact, the approval process for an account can take days to complete.

You may also have to contend with trading accounts shutting down due to glitches in systems. Popular YouTuber Graham Stephan recorded Why I Cancelled Robinhood, in which he details how the controversial exchange wrongly closed his account for two months. Despite multiple efforts to connect with customer service, he could not touch his money during this entire time.

System glitches are not the only barrier you could face as a Bitcoin arbitrage trader. There will be lucrative arbitrage opportunities that you won’t be able to leverage based on citizenship. Above, we mentioned that South Korea tended to price Bitcoin higher than other domestic markets. However, you would have to be a verified citizen to participate in its cryptocurrency exchanges.

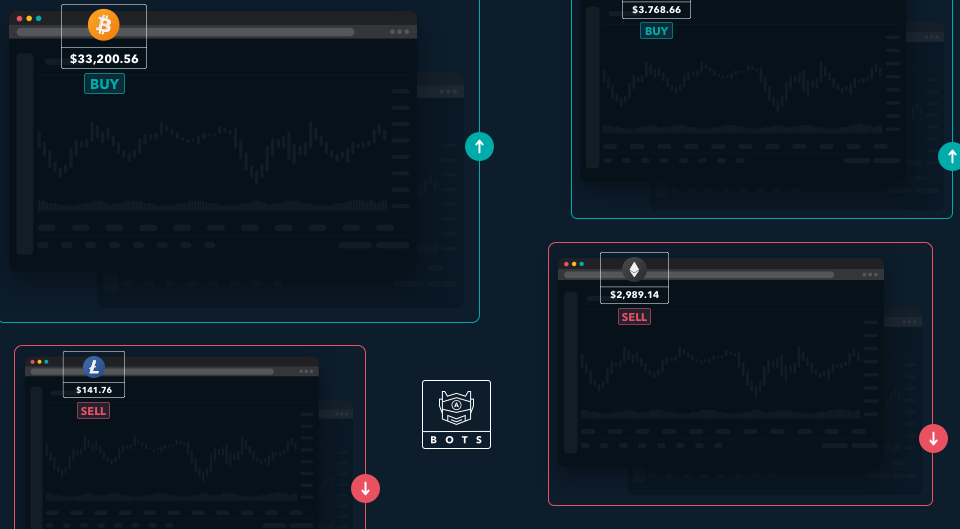

Stay competitive with arbitrage bots

You may have a natural eye for trades and spend hours pouring over crypto news and time series. Yet there’s simply no competing with the rapid computing power of arbitrage bots.

Not all coin arbitrage bots are created equal, so it’s essential to research the various cryptocurrency arbitrage app developers. Steer clear of providers who promise unrealistic gains or lack a seasoned track record. These bots might make poor trades, or worse, outright steal your cryptocurrency as part of a scam.

Additionally, don’t fall into the trap of “setting and forgetting” your arbitrage cryptocurrency bot. This mistake leaves you out of the loop about your own finances and robs you of valuable learning experiences.

Plan for a drop in crypto arbitrage opportunities

There’s no denying, cryptocurrency is increasingly becoming mainstream. Financial gurus that previously snubbed crypto now incorporate Bitcoin and Ethereum into their portfolios. Publicly traded companies like Tesla and Square invest heavily in crypto, and top credit cards like MasterCard and Visa embrace Bitcoin. You better believe hedge funds are taking notice.

So what does this mean for retail traders employing arbitrage trade strategies?

In Crypto Markets Are Where the Fun Is, Matt Levine notes, “Eventually crypto trading will be as competitive as traditional finance, and innovation in crypto markets will be as difficult.”

Independent traders may be able to manually execute arbitrage trades in today’s markets. However, they should begin to investigate different arbitrage bots in order to keep up with an evolving crypto economy and statistical arbitrage (stat arb) techniques.

Diversify your portfolio with Kinesis for ultimate success

The last thing crypto investors should be is discouraged. Mainstream interest is a stepping stone to mainstream adoption, meaning today’s investments could pay off in both the near and distant future.

Diversification is arguably the key commandment of smart money management. Balance your short-term-focused arbitrage trading with long-term investments in crypto and precious metals, as well as retirement accounts, like eg. your US employer’s 401K program.

Kinesis makes it easy to buy, trade, and spend currencies and commodities with a hardware wallet and virtual card.

Secure your digital assets, track collective growth, send money across the globe, and receive regular rewards for spending and storing your money with Kinesis.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.