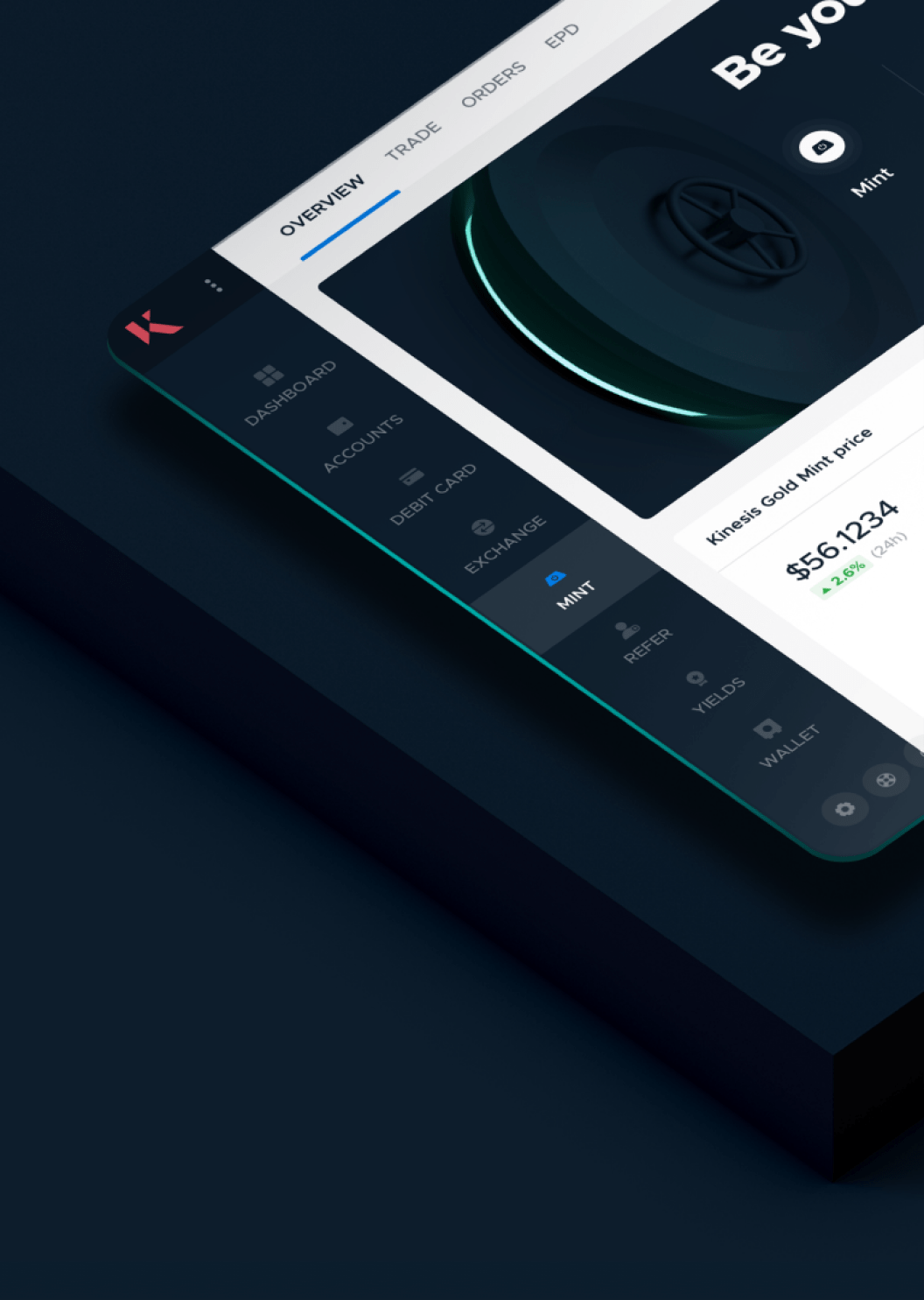

What is minting?

Minting is where users create entirely new 1:1 allocated gold and silver-based digital currency, KAU (gold) and KAG (silver).

Minters instantly purchase large quantities of fully allocated physical gold and silver, introducing new KAU and KAG into the Kinesis system.

Why mint?

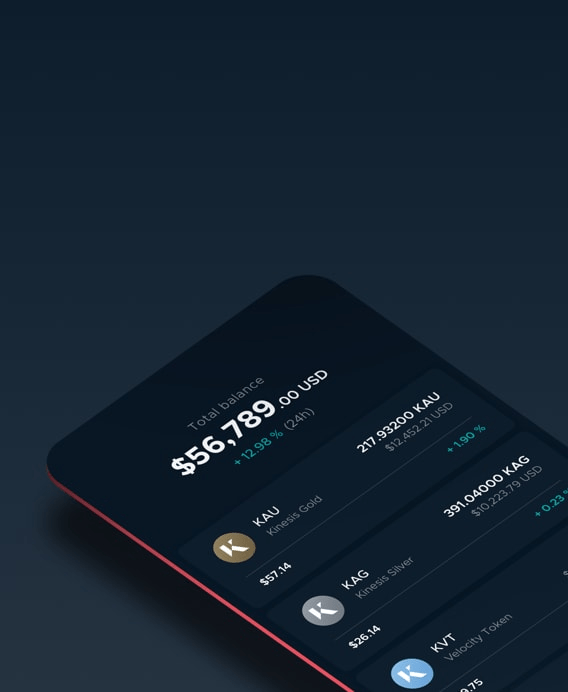

Kinesis rewards users for minting KAU and KAG with access to a lifelong yield paid monthly – the Minter’s Yield.

The Minter’s Yield is paid monthly into the minter’s Kinesis account in physical gold and silver – forever.

How to Mint

Take a few minutes to understand the process of minting Kinesis gold and silver-based digital currencies, KAU and KAG.

Our step-by-step video walkthrough with precious metals expert, Andrew Maguire, walks you through the minting process from start to finish.

Are you ready to start minting?

The best platform in the industry for large-scale metal purchases

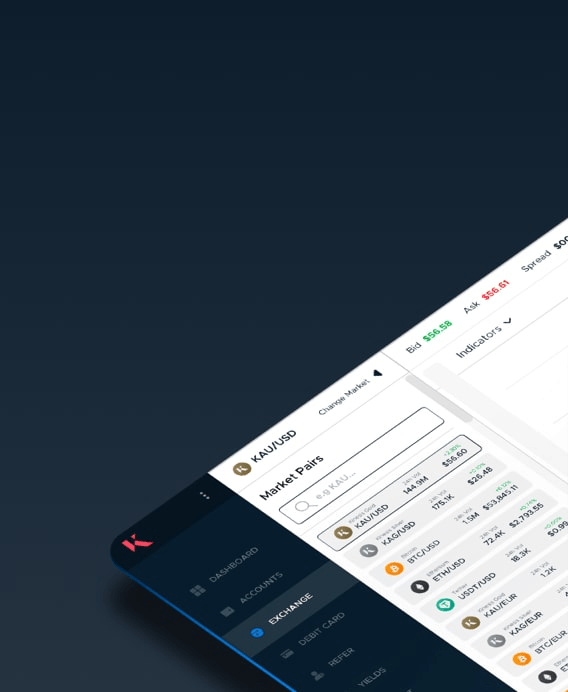

Prices among the best globally

Access industry-leading pricing for spot physical gold and silver.

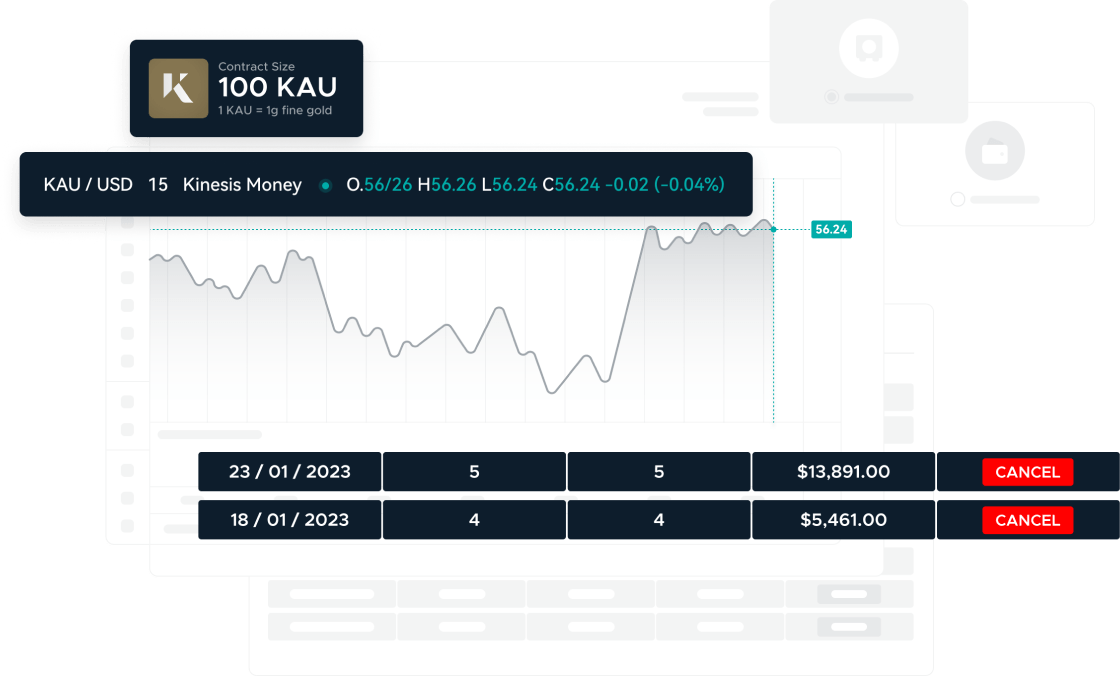

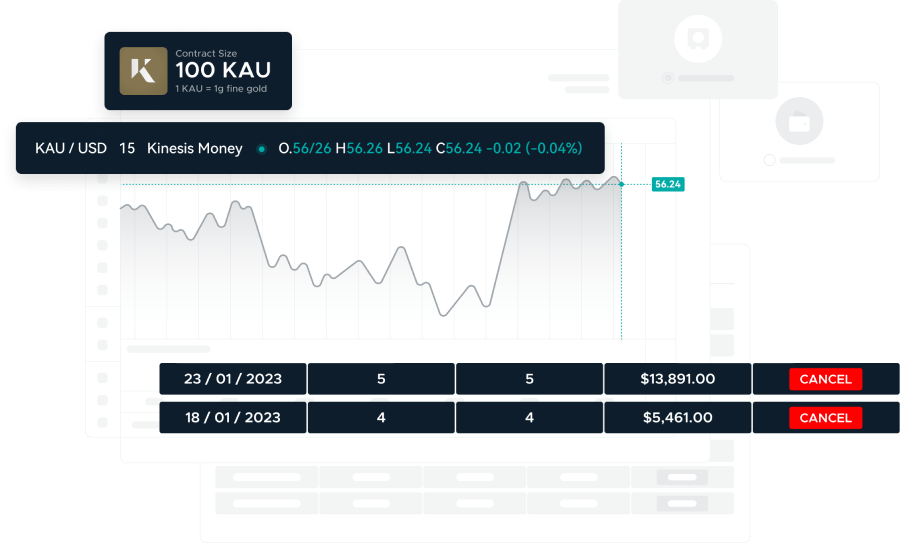

Instant order execution

Find the opportune time to buy via market order or limit order.

Linked accounts

Transfer funds seamlessly between the Kinesis platform and the mint.

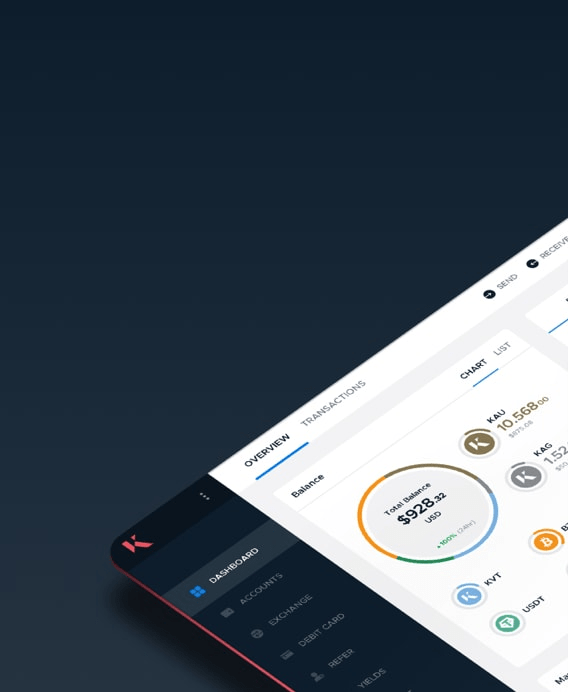

Kinesis gold (KAU)

1 Kinesis gold (KAU) is backed by 1 gram of fully allocated, audited gold bullion

Kinesis silver (KAG)

1 Kinesis silver (KAG) is backed by 1 ounce of fully allocated, audited silver bullion.

Secure & audited bullion vaulting

All of your gold and silver bullion is securely stored in our global vaulting network, where it undergoes independent audits every quarter.

Get 1 KVT for bringing bullion to Kinesis

For a limited time only, earn a Kinesis Velocity Token (KVT) for moving your gold and silver into Kinesis vaults.

Connect your bullion with the Kinesis system

Transfer your bullion into our vaults to experience all the benefits of owning Kinesis gold and silver.

Kinesis Mint market hours

See the trading hours for the Kinesis Mint. While the mint is closed there will be no pricing and trading will not be available.

- EST/EDT

- GMT/BST

- UTC