With all of the factors in place to support a big move higher in the precious metals sector (raging inflation, escalating geopolitical tensions, recessionary economy, etc), the recent market action is frustrating, to say the least.

To be sure, a certain percentage of the poor performance in gold, silver and mining stocks is attributable to the ongoing decline in the general stock market. It’s a bear market.

Will Fed Reversal be Implemented?

When capital pulls out of the markets (stocks and bonds), it pulls out of everything. March 2008 to late October 2008 is a good parallel to the current market. At some point, there will be a catalyst, or catalysts, which trigger a positive divergence of the precious sector from the rest of the stock market. The most likely event will be a reversal by the Fed of its monetary policy.

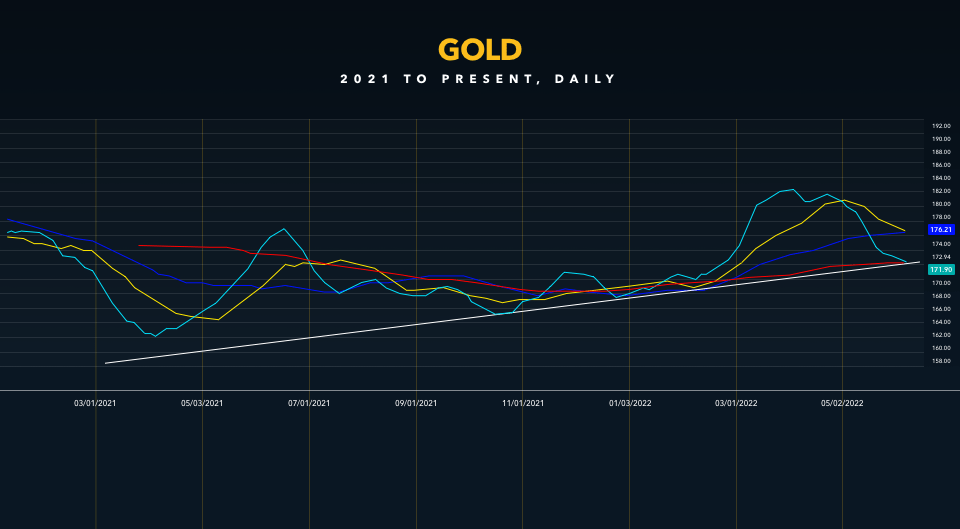

That said, gold continues to move in a steady uptrend that extends back to March 2021:

There have been several successful tests of that upward trend (support line) along the way. Currently gold seems to be holding its 200 daily moving average. While anything can happen in the next couple of months, I expect a big move in the sector sometime between now and the end of October.

Also, keep in mind that the effort to prevent gold and silver from moving higher has been particularly aggressive since gold was turned back from $1975 in mid-April. But 85-90% of the time, gold has been rising during the hours when the eastern hemisphere physical accumulators are trading, getting pushed lower once London and then NY open – which is primarily paper derivative gold trading. When gold shakes off the latest price control effort, it will shoot over $2000 and move higher from there.

Silver Pushes to Move Higher

Since the first week of May, $22 has been a key resistance level, where silver has been in a dogfight with the paper market. When the next leg higher in the entire sector is underway and silver pushes through $22, it should move toward $30 fairly quickly.

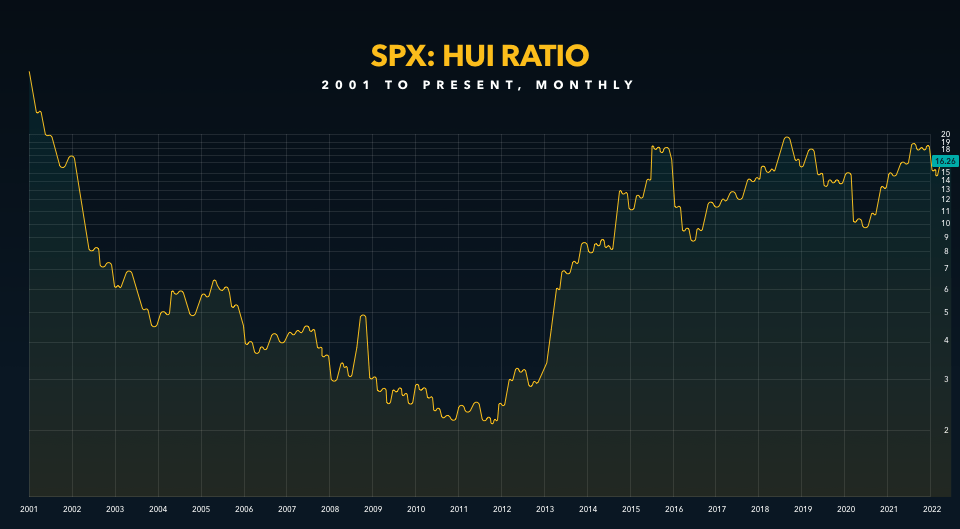

The chart below shows the ratio of the S&P 500 to the Amex Gold Bugs Index (HUI) going back to 2001. I’m using the HUI instead of GDX because GDX did not exist until 2006. I wanted to take this chart back to the end of the 20-year bear market in gold that began in 1980.

The black line was drawn to show periods of time when the mining stocks were incredibly cheap vs the rest of the stock market. The current relative value between the SPX and the mining stocks is back to where it was at the end of 2015 and the end of 2018.

Big rallies in the sector followed. Prior to the end of 2015, the last time the mining stocks were as cheap, versus the SPX as they are now, was in late 2001. At that point, a 10-year bull cycle – inside a longer secular bull market – was already underway.

Unless you believe that the secular bull market in the precious metals is ending, this chart suggests that there is another substantial bull move coming. Obviously, timing is unclear.

What might be the catalyst?

A Historical Retelling?

The more I ponder the circumstances, the more I am convinced we’re watching the summer of 2008 repeat and unfold right now, only this time it will be 10 times worse than back then. First, the housing market is starting to head south quickly. In six to twelve months, most people will be shocked at how different the housing market looked then, compared to now.

Furthermore, the banks are in trouble. If you pull up a chart of Deutsche Bank, you’ll see that it is down nearly 50% since February 10th. DB is the most systemically dangerous bank in the world. Many of the other Too Big To Fail banks are down 25-35%.

The Nasdaq, down 31% from its all-time high in November 2021, is down less than the stocks of many of the world’s largest banks. We have no idea what their off-balance-sheet derivatives exposure looks like but I can guarantee it’s apocalyptic.

Finally, the stock market is in a crash cycle that is still in low gear. When the wheels were flying off the financial system and the economy in 2008, the Central Banks – led by the Fed – flooded the banking system with printed liquidity. They did the same in 2020, though the Fed began in September 2019.

It is unknown whether or not the Fed and other Central Banks will quadruple down on their money printing at some point, or if they’ll let everything collapse this time. But in either scenario, at some point, there will be a stampede into physical gold and silver that will translate into a large, sustained move higher in the mining stocks.

Dave Kranzler is a hedge fund manager, precious metals analyst, and author of a bi-weekly subscription newsletter The Mining Stock Journal. After years of trading expertise build-up on Wall Street, Dave now co-manages a Denver-based, precious metals and mining stock investment fund.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis. The views expressed in this article are those held by Dave Kranzler and not Kinesis.