Kinesis is proud to announce the launch of JFXGOLD X, in partnership with Indonesia’s national commodity and futures exchange, the Jakarta Futures Exchange (JFX).

The launch of the JFXGOLD X product sees Kinesis provide spot physical gold contracts on Jakarta Futures Exchange, for the first time in the government-backed exchange’s almost 25-year history.

JFXGOLD X

JFXGOLD X offers spot physical gold products tradeable on the Jakarta Futures Exchange (JFX), interfaced into both Kinesis and ABX. The Jakarta Futures Exchange (JFX), known locally as the Bursa Berjangka Jakarta (BBJ), offers futures contracts on commodities to major brokers domestically and internationally, generating significant volume.

The launch of JFXGOLD X introduces the substantial client bases of JFX’s broker members immediate exposure to physical precious metal trading. While those investors and traders across Indonesia wishing to access the product, simply require a JFX broker account.

It’s important to note that, while JFX offers futures contracts, Kinesis and ABX will solely be facilitating the trade and redemption of fully allocated physical precious metals.

What does this mean for Kinesis?

Although the branding will appear as ‘digital gold’ on JFXGOLD X, the product offers the trade and ownership of Kinesis gold (KAU). Excitingly, all KAU transactions on the JFX GOLD X platform contribute to the Kinesis Monetary System Master Fee Pool. Therefore, each and every trade made on JFX GOLD X will directly benefit the yields of Kinesis users across the globe.

The JFXGOLD X launch event

The launch of JFXGOLD X was timed in conjunction with a gala event celebrating the 23rd Anniversary of the Jakarta Futures Exchange. The event officially introduced, JFXGOLD X, the first of multiple Kinesis-powered white-labelled platform initiatives with government and national entities in Indonesia.

Kinesis President and Chief Strategy Officer, Eric Maine, attended the event to celebrate the launch and congratulate his JFX counterpart, the President Director, Mr Stephanus Paulus Lumintang. Representing the Indonesia state-owned clearinghouse, PT Kliring Berjangka Indonesia (Persero), President Director, Mr. Fajar Wibhiyada, was also present.

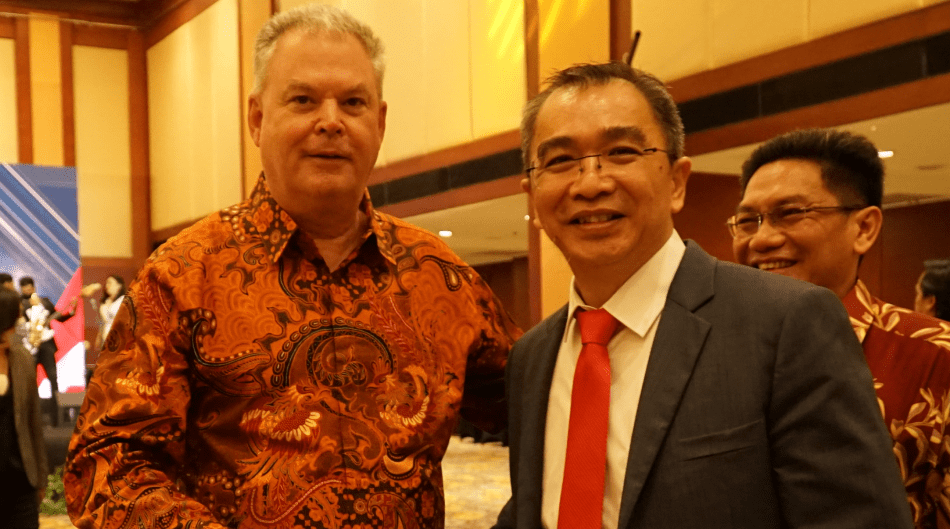

Kinesis President and Chief Strategy Officer, Eric T Maine, pictured with JFX President Director, Mr Stephanus Paulus Lumintang, at JFX 23rd Anniversary and JFX GOLD X launch

PT POS launch

The original intention of PT POS was to launch POSPAY GOLD at the same time as JFXGOLD X. Very recently, JFX asked PT POS to allow a short time between their launch and POSPAY GOLD, as JFX did not want to dilute the impact of the event combining the JFX 23rd Anniversary and JFXGOLD X. PT POS agreed and will set its own independent launch sequence and event, currently scheduled for September.

The importance of JFX for PT Pos and beyond

The JFXGOLD X launch marks the historic nationwide availability of the first of Kinesis’ white-labelled physical gold products in Indonesia.

As JFXGOLD X operates under the same regulation that will govern all upcoming Kinesis-powered physical gold products, including POSPAY GOLD, this momentous launch paves the way for many more.

Additionally, both JFXGOLD X and POSPAY GOLD white-labelled solutions come under the Jakarta Futures Exchange, via their respective JFX broker members. As such, when the Indonesian government launches POSPAY GOLD, the proven regulation and tested infrastructure will allow for a seamless introduction to the POSPAY App’s million-plus existing users.

Although, as many in the Kinesis community will already know, it does not stop there. Closely following JFXGOLD X and POSPAY GOLD, we will see the Shariah-compliant gold savings application, NUGold, brought online for the 100-million-strong membership of the social-religious organization, Nahdlatul Ulama (NU); as well as physical digital gold trading platform, Indonesia Commodity and Derivative Exchange (ICDX). More exciting still, each KAU transaction across all of these upcoming integrations will contribute to the yields of Kinesis users.

The vision

When contemplating the success of the Indonesian integration, we must consider the boundless potential of Kinesis’ public-private partnership model. The national integration not only represents a groundbreaking development for Indonesia but forges a clear, proven and actionable path for the other governments of the world to follow.

As a forthcoming announcement will demonstrate, another government partnership is in full swing. Evidence that the model established in Indonesia is proving both replicable and extremely attractive for other nations. Kinesis’ integration in Indonesia, as monumental as it is, is just the beginning.

With each new partnership formed, more governments will seek to access the benefits of the Kinesis Monetary System. While the technological foundations laid and insight gained will see each new integration implemented with exponential efficiency.

The immense opportunity is clear: government-backed rollouts of such scale can be implemented almost anywhere. Kinesis will continue driving the model forward globally, its unstoppable momentum already in motion.

As each integration brings with it greater transactional velocity and, ultimately, yields for system participants – the future for Kinesis looks very bright, indeed.