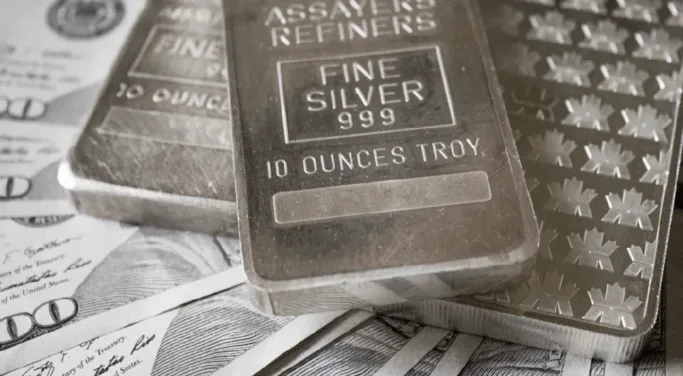

After enduring a loss of almost $3 an ounce from the high silver touched at the start of May, the precious metal has found some support to recover back towards $24 an ounce.

This next phase will be crucial in assessing the popularity of silver among investors currently. The fundamental case for the metal has remained strong throughout the year yet silver has experienced a volatile five months so far, dropping below $20 an ounce at its lowest moments and climbing above $26 at its peak as market sentiment on the health of the global economy and the expectation on the Federal Reserve’s interest rate curve have dominated silver’s price action.

On the face of it, silver should be set for a period of positive performance with the Fed’s interest rate hike cycle seemingly on pause and promising noises emerging on talks on the US raising its debt ceiling both potential developments for the precious metal.

A strong US economy free of default concerns will bolster already strong demand for silver and enable President Joe Biden to pursue his green agenda outlined in his Inflation Reduction Act and drive further investment in sectors that require silver such as solar energy and electric vehicles. So while gold may have already touched its high for the year, the price of silver still has plenty of potential to climb back above $26 an ounce and then even push on towards $30 given a fair economic wind.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice.