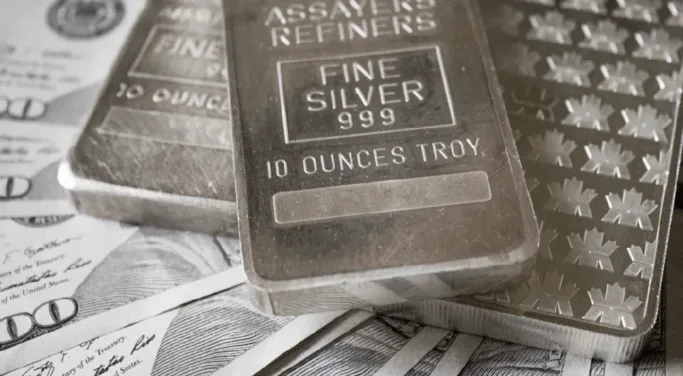

Silver may finally have found a level at which investors are willing to back the metal with the price holding above $19 an ounce.

While this means that silver is trading at levels not seen for two years, the apparent pause in declines is something to be welcomed for silver investors who have seen the price of their holdings plunge by more than $7 an ounce in recent months.

The main agent of silver’s punishment has been the Federal Reserve’s switch to a more hawkish monetary policy and this month is now almost certainly going to see another 75 basis point interest rate hike by the US central bank after last week’s promising jobs numbers reduced concerns about high interest rates tipping the economy into recession.

A Fed set on a course of ever-rising interest rates allied to an ever-strengthening dollar have created painful market conditions for silver, which has suffered far more than its golden brother.

One glimmer of hope for silver holders could be gleaned from the recent US payrolls data. The economy so far is holding up better than many had expected and given silver’s industrial appeal and positive fundamental outlook, brave investors may see the recent holding above $19 as the potential bottom for silver’s price and could be tempted to bet on silver’s recovery from here. With silver it is often a rocky ride but don’t dismiss the possibility of the metal reaching $30 before the end of the year.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.