Gold continues to drift sideways around $1,930 an ounce as it is trapped between two equally strong bearish and bullish drivers.

The continuation of the war in Ukraine with Russian troops being primed for a fresh offensive in the east of the country is keeping gold supported due to its time-honoured safe-haven appeal. However, gold’s potential for fresh gains is being capped by the hawkish monetary policies of central banks in Europe and the US.

Minutes from the March meeting of the Federal Open Market Committee released earlier this week showed that a number of officials would have favoured raising interest rates by 50 basis points, double the increase actually agreed.

The minutes also suggested that there will be a further six rate hikes over the course of the year with each one likely to knock a little of the lustre off gold’s appeal to investors with its lack of yield a stumbling block in an environment of rising interest rates.

While the European Central Bank still remains some way off interest rates entering into positive territory, with the first hike not forecast until December, it has signalled that the war in Ukraine hasn’t deterred its intention to end net-bond buying in July as the pressure from rising inflation ensure that the time for accommodative monetary policy is over.

With no end in sight for the war in Ukraine and central banks set on their medium-term economic policies, gold looks set to continue to drift for a while longer yet, awaiting either a further escalation in the conflict in Ukraine or a breakthrough in peace talks to shake the price into action.

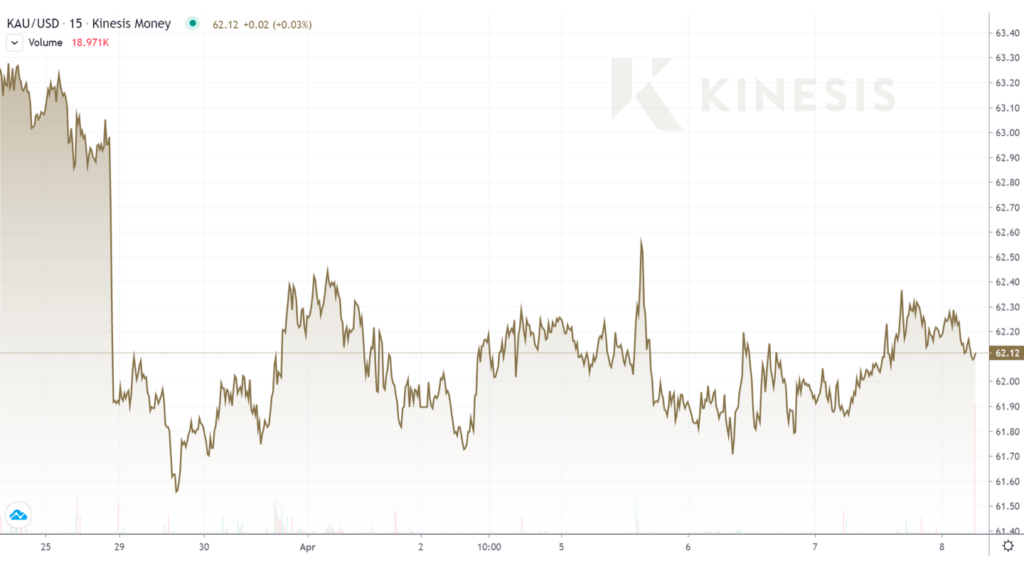

Monitor the Gold Price with Kinesis’ Live Charts

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis