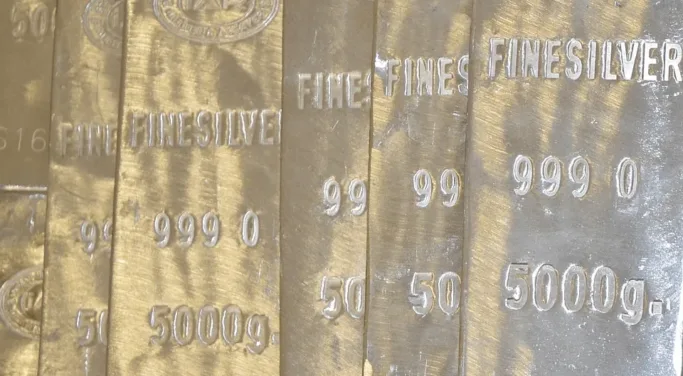

Silver is striding towards $21 an ounce after a slight weakening in the US Dollar gave the metal sufficient wiggle room for its strong fundamental case to gain more prominence.

Silver’s recent price action has shown a metal desperate to climb significantly higher than its current levels but having to overcome considerable pressure from ever-rising interest rates in order to do so.

Last week brought large interest rate hikes by both the Federal Reserve and the Bank of England yet silver was still able to make a weekly gain. Considering it was the Fed’s signalling and subsequent implementation of a series of interest rate hikes from April onwards that triggered a multi-month plunge for silver, the fact the price is able to make gains even with rate hikes continuing highlights the switching of focus to the longer-term outlook for the metal rather than short-term concerns.

If this week’s US midterm elections provide a negative reaction for the US dollar, then silver could make further gains with strong support clearly mounting behind the metal to try and recover all of the losses since March.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis