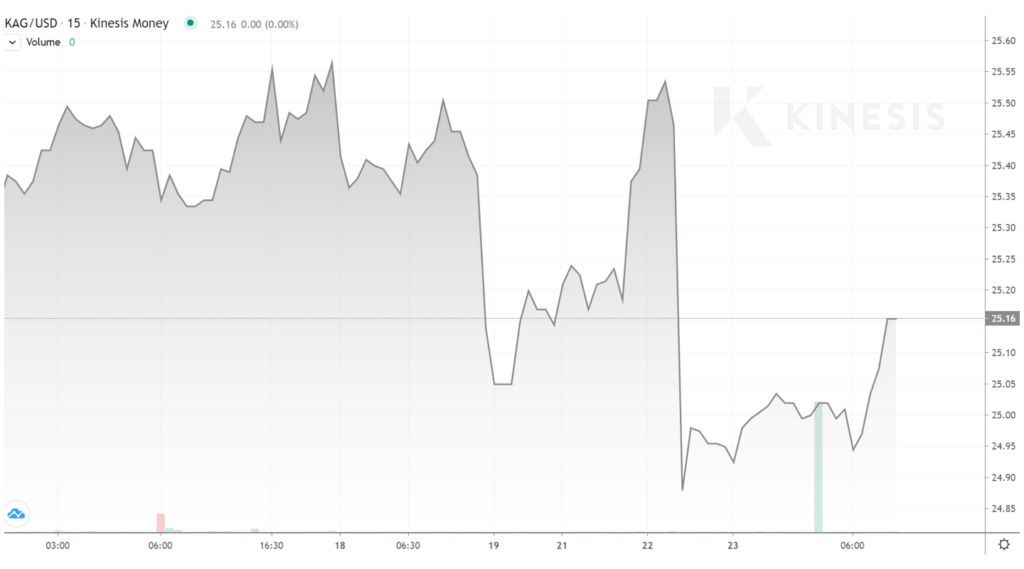

Silver has managed to rally to be trading above $25 an ounce once again. The metal has now dipped below $25 three times in the last week or so and on each occasion it has quickly rebounded back above that threshold, illustrating the underlying strength of investor sentiment.

Silver’s bullish factors include residual fears among investors over the war in Ukraine driving them towards haven assets; rising inflation making silver attractive as a hedge against rising prices; and a fundamental outlook that sees increased demand for the metal, notably as countries look to speed up the rollout of solar energy that need silver in the photovoltaic cells.

Against that there is the expectation of multiple rate hikes by central banks across the world this year, with the Federal Reserve and the Bank of England already having made their first moves.

These measures to try and curb inflation are the main headwinds for silver as higher interest rates make assets that don’t produce any yield, like silver, less attractive as well as typically strengthening the currencies whose central banks are raising rates, putting commodities priced in them under additional pressure.

Overall, the outlook for silver looks more bullish than for gold and it will be interesting to see if silver can break out its strong correlation with gold and track its own course higher while gold treads water.

Find out more about what Kinesis has to offer

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.