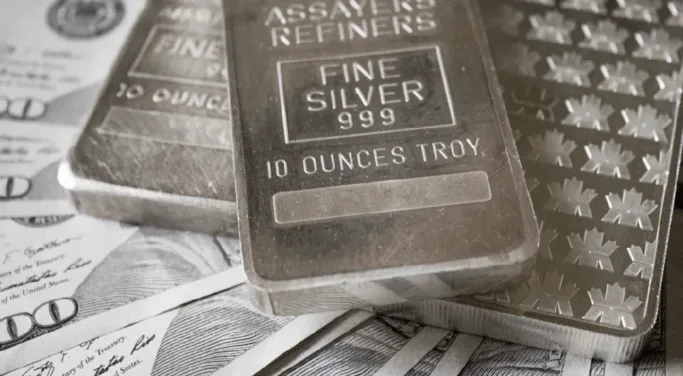

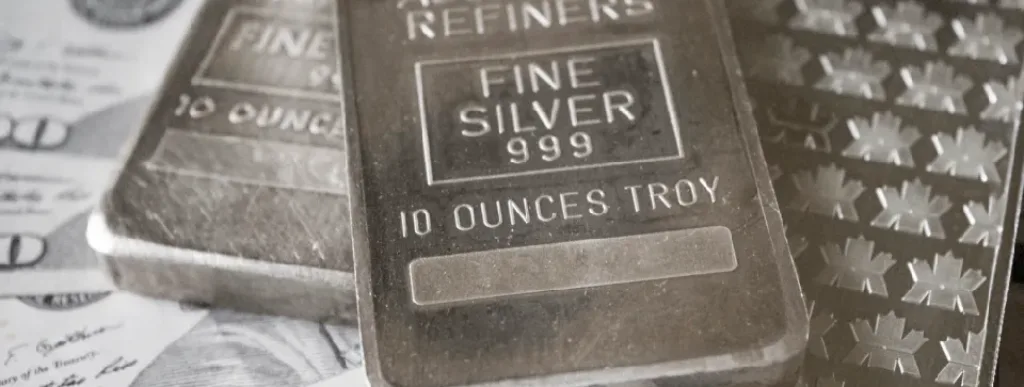

The silver price jumped by around 10% during November having reached a bottom below $18 in September and is now traded at $21.3-21.4, consolidating recent gains. The performance of silver in November saw the grey metal halving the decline posted in the first ten months of 2022.

The overall economic scenario has changed in the last few weeks, with a slowdown of the greenback and investors forecasting a less hawkish Fed in the next few meetings. We should also point out that silver in November finally outperformed gold.

It almost seems that investors suddenly realised the precious metal was undervalued, particularly considering the strength of demand and growth expectations for the metal in 2023.

From a technical point of view, there are solid support areas between $20.6 and $20.8. In this range are the bottoms reached in May and June, but also the relative peak of August. The silver price is now dancing just above this, consolidating after the recent rallies and seems to be just waiting for catalysts which could further enable its positive momentum.

Of course, any dovish indication coming from this evening’s speech by Fed chairman, Jerome Powell, could be one such catalyst. Vice versa, any hawkish rhetoric could curb the current recovery.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.