Gold is recovering more ground as investors shake off Federal Reserve Chair Jerome Powell’s cautionary remarks to push the price back up towards $1,900 an ounce.

The gold market seems to have an element of traders and investors hearing what they want to hear rather than what is actually said as despite the Fed Chair saying on Tuesday that further interest rate hikes are needed to fully curb inflation, his tone was interpreted as less aggressive than previous and therefore reason for gold to gain.

While it is fair to say that the period of 75 basis point hikes by the Fed may be behind us, the reality is that the US central bank increased its benchmark rate when it met at the start of the month and is likely to do so again in March.

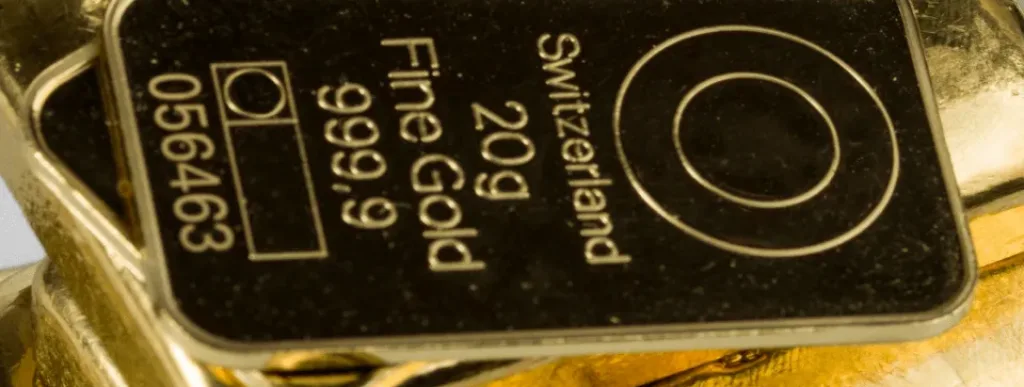

Given that gold suffers at periods of rising interest rates, due to its lack of yield making other interest-bearing assets more attractive, the fact that the precious metal is once again on an upward trajectory and nearing $1,900 is remarkable.

One factor that could well be keeping the gold price so supported is the strength of buying from central banks, including those in China, India and Turkey. As these fast-growing economies look to diversify away from the hegemony of the US dollar, these banks have bought considerable volume last year with that trend expected to continue into this year.

Given that the macroeconomic conditions would otherwise point to an environment in which gold might struggle, the fact that gold continues to trade at such elevated levels points to a significant bedrock of support holding the price up, the kind of support that only the largest institutions can provide.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.