The Russian invasion of Ukraine remains the main market driver of late, but after two weeks of conflict acting as virtually the only catalyst, investors have now focused their attention on the macroeconomic scenario.

On Wednesday, as expected by traders, the Federal Reserve announced the first post-pandemic interest rate hike – a decision forced by the rally of inflation, as the growth of prices in the US hit a new 40-year high at 7.9% (for the past 12 months).

The Federal Reserve’s outlook on interest rates has grown significantly more hawkish since last year, with more than half of top central bank officials predicting at least seven quarter-point rate hikes in 2022.

The forecast coming from the Fed’s so-called “dot-plot”, a summary of the top officials’ rate predictions, will give investors insight into rate increases in the range 2-2.25% by their December meeting. Of course, the macroeconomic data over the last few months will be crucial for predicting upcoming FOMC decisions.

The oil price is still under the spotlight, primarily for its correlation with the inflation rate. Despite oil retraced from the recent peak it reached at around $130 per barrel, both West Texas Intermediate and Brent, remain traded at around $100.

Gold Analysis

Investors’ interest in bullion remains ever-present, with the gold price having just rebounded to $1,940 after testing the support zone of $1,900. Despite the decline of the last few days, mostly due to a return of “risk-on” sentiment on the markets, bullion remains strongly in the green (YTD), with a positive performance of 6%.

From a technical point of view, bullion is traded just above two key support zones. The first one is represented by the $1,920 area – where the former 2011 records were placed. This is closely followed by the $1,900 threshold.

A clear surpass of $1,950 per ounce would represent a new positive signal for bullion, opening space for further recoveries. The following resistance are placed at $1,965, $1,980 and $2,000. The evolution of the war between Russia and Ukraine and the next Fed’s decisions will be the main market drivers for the gold price.

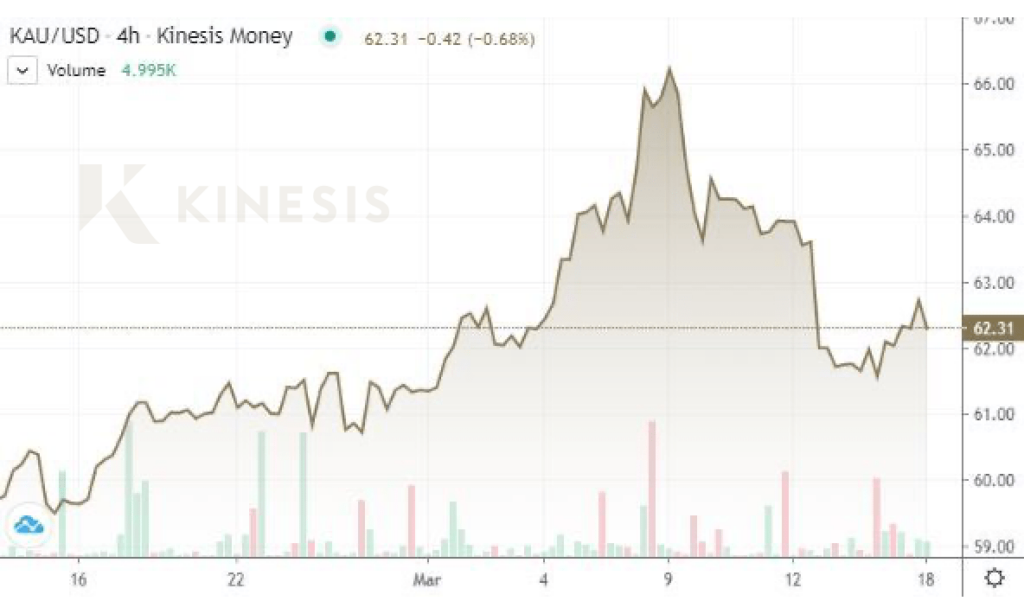

Analysing the gold price in dollars per gram, we can see that gold is still traded above $62.

Find out more about what Kinesis has to offer

Carlo Alberto De Casa is an external Market Analyst for Kinesis Money.

He also writes as a technical analyst for the Italian newspaper La Stampa.

Carlo Alberto provides regular commentary for UK outlets including the BBC, Telegraph, the Independent Bloomberg & Reuters. He is also a commentator for CNBC Italy. He worked for Bloomberg as their Equity Research Fundamental Analyst before joining brokerage ActivTrades in 2011 to specialize in currency markets and commodities. In 2014 he published a book on gold and the gold market, followed by a new updated edition in 2018.

This report is not an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance.