KEY TAKEAWAYS

- Central bank decisions in 2024 continue to be pivotal for the silver market. These decisions can significantly influence market dynamics and investor sentiment.

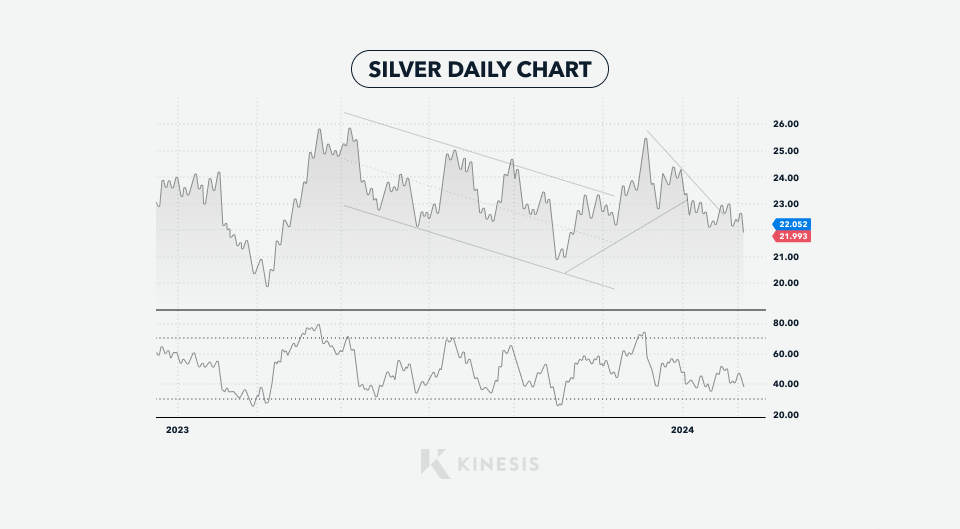

- Technical analysis indicates critical thresholds for silver prices. A drop below the support range of $21.9 to $22 could lead to further declines. Conversely, a resurgence above the $23.2 resistance level may create opportunities for gains.

- Silver’s physical demand remains exceptionally strong, primarily fuelled by its applications in photovoltaics, electric vehicles, and 5G technology. This robust demand underpins silver’s integral role in modern industries.

- Mexico, as the leading producer of silver, plays a crucial role in the global silver market. However, regulatory changes introduced in 2023 by the Mexican government could decrease the country’s appeal to mining companies. These changes have medium to long-term implications on silver’s pricing and availability.

Silver is a crucial asset in the global economy, not only due to its industrial applications but also for its broader economic impact. Its excellent conductivity makes it essential in many industries, including photovoltaics, electric cars, and 5G technology. Many electronic devices, such as computers, mobile phones, and auto vehicles, contain silver. Furthermore, the widespread use of silver extends to jewellery and coinage, and it occupies a key role in the investment sector.

In terms of market dynamics, the price of silver typically exhibits more volatility than that of gold, leading to wider swings in both upward and downward directions. This implies that silver may offer more substantial gain opportunities in a bullish market than gold. However, it also means the potential for larger percentage falls during price corrections should not be overlooked.

The Price of Silver – An Overview

Silver, like gold, started 2024 with unusually low volatility. Its price declined from $23.7 to $22, interspersed with temporary rebounds, against a backdrop of lingering uncertainty. This trend was influenced significantly by robust US macroeconomic data and a rebound of the US CPI, which considerably diminished the likelihood of the Federal Reserve reducing interest rates in March 2024. This landscape bolstered the US Dollar and led to a modest uptick in bond yields, resulting in a challenging environment for both gold and silver.

For now, investors are awaiting new market drivers, particularly seeking more definitive indications about the number of rate cuts that the Federal Reserve will put in place in 2024. These decisions will have a direct impact not only on the broader economy but also on the US Dollar, Treasury yields, and the prices of gold and silver. A dovish stance by the Fed could lend support to silver prices, whereas a prolonged period of high interest rates might impede its recovery.

Technical analysis of silver

From a technical perspective, there are some key levels to monitor. An important support area has been established between $21.9 and $22.2 per ounce.

A decisive drop below this range would signal a strengthening of the bearish trend. However, should further declines occur, silver is anticipated to encounter robust support between $20 and $21. These levels mitigated bearish momentum in March and October last year, leading to significant recoveries. For now, the low seen in October 2022 at $18 seems far away.

On the other hand, a solid recovery above the resistance level of $23.2 could open space for further gains, with potential targets at $24.4, $25.05, $25.4 and in the region of $26, on the double top reached last year in April and May.

Furthermore, it is crucial to note that from a technical perspective, silver has breached the recent bearish trendline. While this break-out has not yet triggered a significant rebound, it indicates a growing interest from buyers whenever the price nears the $22 mark. Nonetheless, the prevailing strength of the US Dollar poses a challenge to any recovery attempts.

Silver demand

As we await the official data for 2023, analysts are confident that the global industrial demand for silver is on the cusp of reaching an unprecedented high.

The appetite for the precious metal remains robust, driven by its increasing use in solar panels, electric vehicles, and 5G telecom networks.

The Silver Institute predicts that after years of surplus, we have moved into a deficit era: in 2023, demand for silver was higher than supply for the third consecutive year. This marks a paradigm shift, indicating a substantial structural market deficit that is expected to persist in the current scenario and over the coming years.

Analysts are still determining whether this shift is fully reflected in silver’s spot price. The consensus for future price predictions remains mostly positive, suggesting that the market might still need to adjust to this new demand-supply imbalance.

Silver production and regulatory changes

As we anticipate the official production figures, analysts have estimated that silver production in 2023 will have increased by approximately 100 million ounces, rising from 919 to around 1,030 million ounces.

Mexico remains the main producer of silver, with a share of 25% of the global production, ahead of China and Peru. However, it is essential to note that in 2023, Mexico announced new regulatory changes, with shorter concessions and stricter rules for mining companies. Additionally, obtaining concessions has become more challenging for prospectors, as they now must win a public bidding process overseen by Mexico’s economy minister—a departure from previous regulations that typically favoured the first applicant.

These policy shifts in Mexico could deter mining companies from investing in the country, which may affect silver prices in the medium to long term. Moreover, other nations may also adopt similar regulatory measures in the near future.

Sustainability is increasingly becoming a focal point for both governments and mining companies. The Silver Institute states on its website, “Mining and refining member companies of the Silver Institute are committed to a sustainable future with a healthy environment and economic prosperity”.

This commitment involves limiting land, water, and air pollution, reducing waste generation, and minimising environmental impacts. Such an approach underscores the industry’s growing emphasis on environmental stewardship and sustainable mining practices.

Carlo is an external market analyst for Kinesis Money. With a credential background in Economic Finance and International Exchange (MA), Carlo’s critical analysis of gold and silver markets’ performance is frequently quoted by leading publications such as Forbes, Reuters, CNBC, and Nasdaq.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.

Read our Editorial Guidelines here.