Gold has traditionally played a key role in the financial sector, becoming the most common safe haven in market storms. Its crucial role in a financial portfolio remains unchallenged and it seems very likely to continue for a long time.

Gold represents stability, with central banks increasing their holding of bullion as reserves. Despite this, investors are always fighting against the markets while trying to find the best timing for buying bullion.

Another interesting point of analysis is the distinction between buying physical gold or paper gold and what are the advantages of both.

This article starts by explaining the current scenario for bullion, before analyzing the market drivers which are forecasted to move the gold price in 2022. The analysis continues to present the advantages offered by Kinesis Money to gold investors.

What is the current state of the market?

In the last few months, investors faced a challenging scenario. The Federal Reserve announced the beginning of tapering, while inflation continued to soar in the U.S. and in several other countries, proving to be much less transitory than forecasted by Central Banks. Moreover, the battle against Covid-19 is not yet over, with spikes of volatility due to the news related to the pandemic.

Despite this, stocks continued their long rally that started in April 2020, with the market capitalization of almost all the major indices now surpassing pre-Covid-19 records. For example, the S&P 500 has reached the 4.700 points mark, around 900 more than the top of February 2020, while the Dax topped above 16,000, before slowing down after the growing fears related to the new Covid-9 variants.

On the bonds market, the yield of the U.S. 10-year treasuries remains in the region of a modest 1.50 – 1.70%, well below the current level of inflation. But the scenario could change if inflation pressure continues to rise, or in the case that investors sense a risk that the price growth seriously goes out of control. Once again, gold seems ready to play a crucial role in the markets.

Investing in Gold in 2022

There are not many certainties in the financial environment. However, it is certain that gold will continue to be a crucial asset for an investor’s portfolio, despite potential changes in the market.

Why invest in Gold in 2022?

The reasons for holding gold might be various and at times – complementary.

Firstly, consider investing in gold in anticipation of its price rising. By holding your gold long-term, you can expect to achieve a capital gain as the price of bullion increases over time.

1. Gold is an appreciating store of value

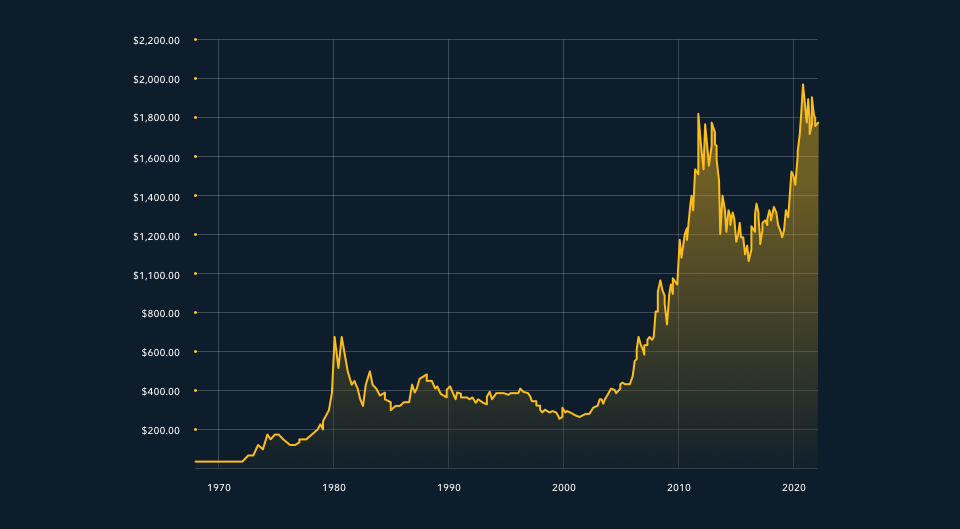

Charts speak for themselves, especially in a longer timeframe:

Over the past 50 years, gold achieved an average yearly performance of +10.6%, while in the last 20 years bullion price increased by 600%. The former historical top of 2011 at $1,920 was surpassed in the summer of 2020, when gold temporarily jumped above $2,000, before slowing down to $1,800/1,900.

2. Gold is a Safe Haven

Another reason to incorporate gold into a portfolio is to protect yourself in the event of stock market turmoil. Historically, bullion has proved to be an excellent safe haven in the unfortunate scenario of share market collapse.

An example of that was observed throughout the global stock market crash in February 2020, when gold managed to retain a positive performance (excluding the first chaotic weeks of March, where many traders were forced to close their position in gain on gold, in order to avoid margin calls on stocks and bonds).

3. Don’t put all Your Eggs in One Basket

Holding gold is an excellent way of diversifying a portfolio, in line with the wise advice of Don Quixote. Gold is a unique commodity, with a low correlation to the majority of raw materials – and can also be used to mitigate potential risks.

4. Gold is a Hedge Against Inflation and Market Adversities

Speaking of risk, bullion is well-suited to play an important role in the event of currency market turmoil. Central banks printed trillions of dollars, euros, pounds and yen in the last few years. As we try to crawl back to so-called normality, the Fed’s hawkish monetary policies might not necessarily make it any easier.

If investors lose their trust in central banks, gold could definitely jump to new highs. Therefore, its safe-haven role is also remarkable when analyzing the forex market.

For investors, based in countries where the local currency is extremely volatile – as in Russia, India, or Turkey for example – gold could also be used as a hedge against further depreciation of the native currency.

Moreover, bullion could also be held as a hedge against inflation. However, this subject may turn out to be a little tricky, as the relationship between gold and inflation is not always linear.

What are the main market drivers for gold in 2022?

Any gold price forecasts for 2022 should take the inflation rate and the Fed’s monetary policy into consideration. Of course, the development of the pandemic should be carefully monitored.

Now, let us analyze the main elements for gold investing in 2022, in more detail:

1. The Federal Reserve’s attempts at curbing Inflation

Despite the Federal Reserve’s tapering announcement, gold managed to perform positively in October and November 2021. This happened mostly due to growing fears around uncontrolled inflation, which remains a central topic as we enter the new year.

Indeed, in the event of investors losing their perception of central banks having enough control over price growth, a gold buying spree may ensue.

Therefore, inflation and the central bank’s decisions over interest rates are two crucial market drivers for the gold sector.

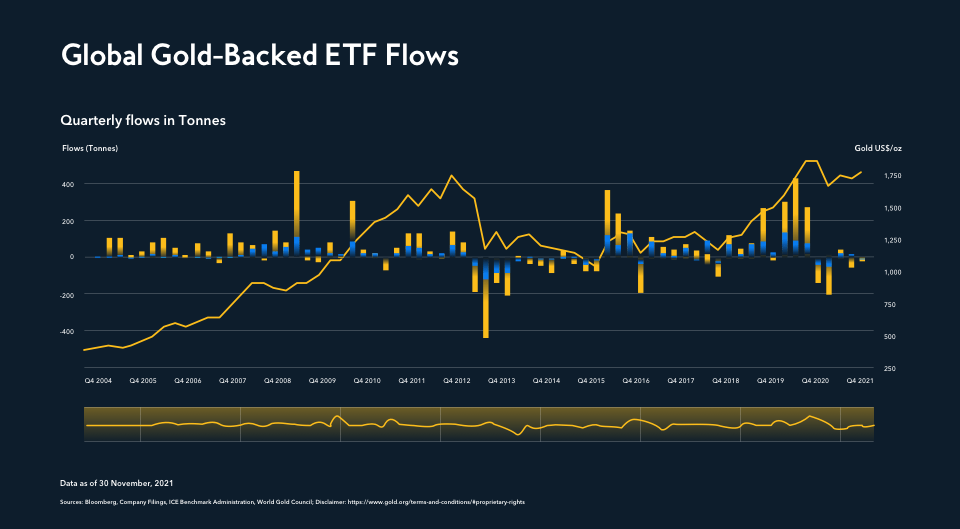

2. Gold-backed ETFs

In recent times, the demand for gold coming from physically-backed ETFs, has shown a strong correlation with the gold price. The growth in this sector could further boost the price of gold, in case the inflows continue.

3. Growing Demand for the Physical Gold

In the last decade, we have seen strong demand for physical gold coming from central banks. Many countries, including Russia, China or Poland, vastly increased their gold reserves. It will be interesting to see whether this trend will continue in the next few years.

Jewellery historically represents a strong percentage of physical gold demand. In this case, analysts are trying to forecast the solidity of jewellery sector demand for 2022-2025, and its potential impact on the bullion price.

What are the key levels for the gold price in 2022?

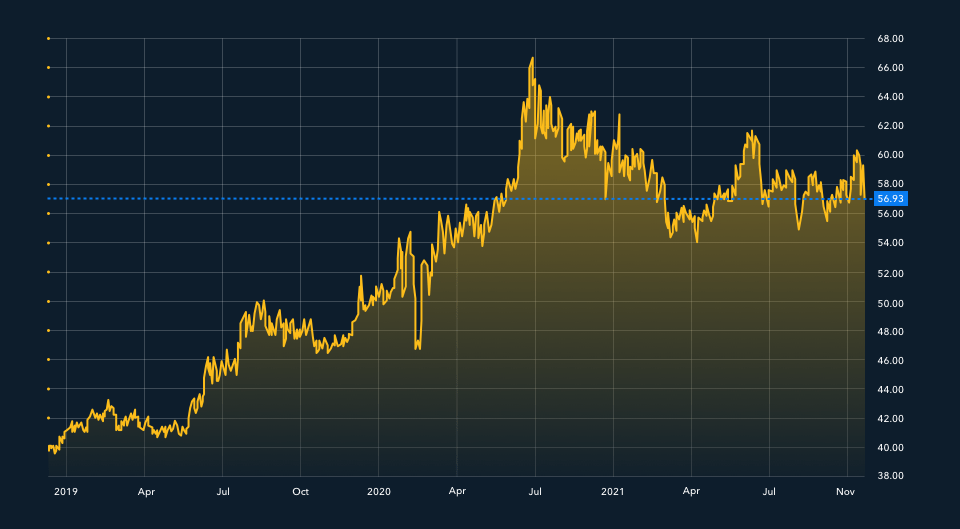

If we take a look at the 2019-2021 gold price chart, we can identify many interesting support and resistance points that can later aid us in monitoring the year 2022.

Let us start with analyzing the key resistances – the areas which can curb gold appreciation, and where we could expect sellers to be more active.

In the current scenario, with bullion traded at around $1,800, the first major level to monitor is placed at $1,870, on the top reached in November 2021. A surpass of this threshold could generate a further rally to the historical 2011 top in the region of $1,920, while the following key levels to monitor would be the psychological $2,000 mark which led to the historical high in July 2020, at $2,074.

Similarly, in case of a new decline, the support zones – where we could expect significant buying volumes – are placed at $1,750 and also in the $1,670-$1,680 region. Much further, we can find $1,620 and the $1,520 – $1,500 area.

How to Invest in Gold in 2022?

As many investors are looking for the perfect way to invest in gold, it’s important to make an informed choice between options available on the market. What are the differences between physical gold and paper gold and are there any emerging alternatives to these two choices?

Paper and Physical Gold – What are the Key Differences?

Physical gold has the advantage of tangibility, however paper gold is usually much cheaper in terms of spreads and commissions. Moreover, it is also easier and quicker to buy and sell. Thanks to modern trading platforms, it is possible to purchase and sell paper gold in just a few seconds, profiting from both short and long-term bullion movements.

Fully Allocated, Digitalised Physical Gold

Conclusively from this analysis, precious metals-backed digital currencies – such as Kinesis KAU & KAG – could represent the perfect solution for modern investors. Kinesis native currencies merge both the enduring value and security of traditional physical gold with the technology-driven liquidity and ease of paper gold.

Kinesis offers two tokens: Kinesis gold (KAU) and silver (KAG), which can be easily traded online. At the same time, the precious metals that back them are stored physically in Kinesis vaults and can be redeemed in physical bullion anytime, anywhere around the world. Moreover, Kinesis is paying KAU and KAG holders a recurring monthly, passive yield, which is paid directly into the holder’s account in gold and silver.

The Kinesis system also offers a sense of immediacy. Holders who store their gold with Kinesis, have the ability to spend, send and transfer their KAU and KAG as digitalised, physical currencies, just like regular cash.

To summarise, with Kinesis Money assets, investors can access the benefit of receiving a monthly yield, traditionally associated with bonds, coupled with the potential growth of the physical gold price. Moreover, they can trade Kinesis gold just like paper gold, while also having the option of converting the Kinesis token into physical gold, whenever they wish to do so.

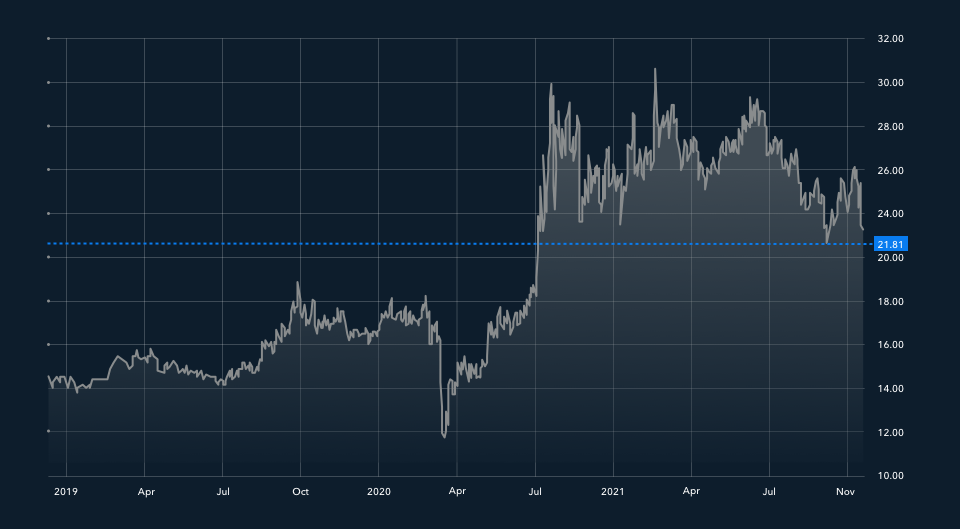

Investing in Silver in 2022

It’s not just gold that glitters. In the precious metals environment, silver could also represent an interesting opportunity to diversify an investor’s portfolio.

Silver metal is generally more volatile than gold, with wider movements in both directions. In other words, during the positive growth phases, silver can gain more value than gold (in percentage), while falls can also be broader.

Many precious metal analysts, including the renowned Robert Kiyosaki, have a positive view of silver. Although its price seems to have been dramatically compressed in the last few years, with the rapid popularisation of physical silver – which is also reflected by the accelerating expansion of silver-focused online communities, such as Reddit-based WallStreetSilver – this could be the right time for the metal to start restoring its real market value.

The global physical demand for this precious metal is expected to grow in the future. In the last decade, we have already seen a tremendous increase in the industrial silver demand from the photovoltaic sector.

In the upcoming years, analysts have forecasted a huge increase in the request for silver as a component in electric vehicles. Of course, this could have a strong impact on the silver price, increasing the chances that silver can outperform gold in the long run.

Gold Vs. Silver Demand

It is interesting to analyse the different uses of these two precious metals.

Gold is mostly used in jewellery and has a significant component of the demand from central banks and the investment sector.

Silver, on the other hand, is more exposed to the industrial demand and this could also represent an interesting point allowing investors to diversify their investment in silver.

Both precious metals are equipped with a number of benefits that will make an excellent addition to any investor’s portfolio. However, the decision between gold or silver, as well as the form in which you find them most fitting your personal needs – is entirely up to you.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.