In this article, two popular investment vehicles are explored: gold and stocks, with a focus on comparing the relative benefits and considerations of both.

While gold is generally viewed as a lower-risk asset with the capacity to store value in the long term, stocks are often perceived as a riskier asset class due to their volatility, with the potential for granting high returns.

Whether gold is a better investment than stocks or vice versa, depends on the needs of the investor. Does the investor prioritise wealth preservation? Growth? and what is the time horizon?

Find out more about these investments down below.

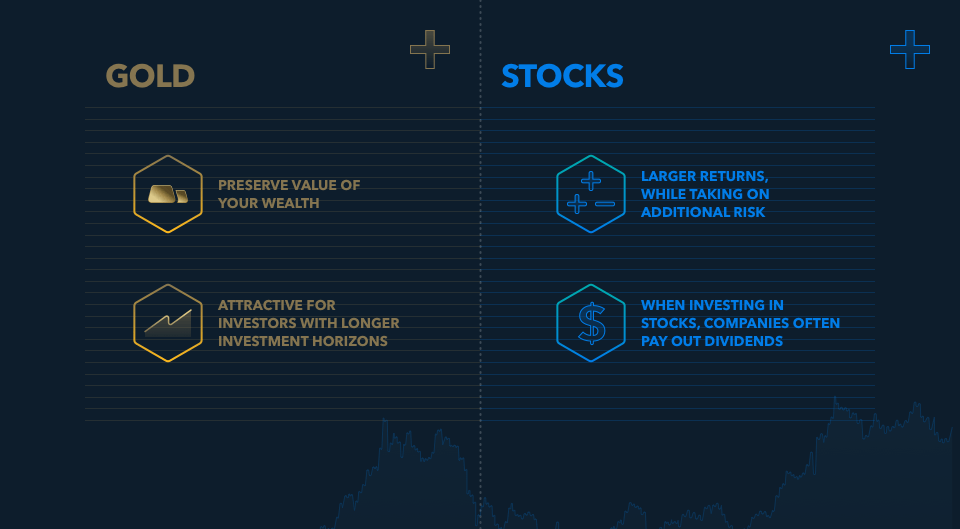

Advantages to investing in gold

Gold is a good fit if your priority is to preserve the value of your wealth.

Perhaps now more than ever before, people are now looking for an asset that stores the value of their wealth. Gold is unique among other asset classes, having historically served as a proven hedge against inflation. Since the abandonment of the Gold Standard in 1971, when President Nixon unpegged the quantity of dollars from gold reserves, inflation rates have been on the rise. The prospect that inflation will be a prolonged issue makes gold’s property as a hedge increasingly attractive.

Gold has stood firm throughout history. Consider the Great Depression, the 2008 Financial Crisis, and the effects of the COVID-19 pandemic – during all of these events, gold prices hit record highs. Even in the midst of liquidity draining the US economy during this year’s central bank quantitative tightening policies, gold has shown remarkable resilience.

Gold is attractive for investors with longer investment horizons.

Being a safe haven asset doesn’t mean gold can’t generate returns; in the medium to long term, gold has tended to demonstrate a significant upside. For example, from 1990 to 2020, gold prices rose by about 360%.

Advantages to investing in the stock market

Investors looking for large returns may select stock investment – while taking on additional risk.

Over the same period (1990 to 2020), the Dow Jones Industrial Average (DJIA), a widely-used measure of overall stock market performance, rose by 991%. While stocks are considered riskier investments than precious metals like gold, the stock market can present attractive returns if short-term gains are sought after.

For example, during the Federal Reserve’s quantitative easing program following the COVID-19 pandemic, the S&P 500 doubled in the shortest time frame in history, going from 2237 to 4479 in just under one year.

When investing in stocks, companies often pay out dividends.

Dividends are paid out when companies channel a portion of their profits back to their investors, which can be compounded when reinvested.

Dividend yields often vary depending on company profits and something to consider is that not all companies offer dividends in the first place. Nonetheless, investors may find the steady cash flows attractive.

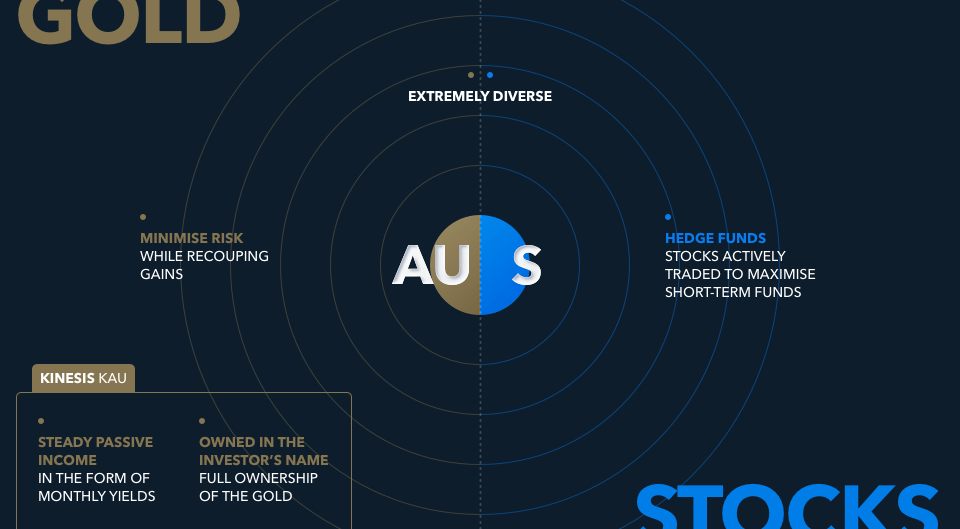

Gold vs Stocks

It might be tempting to oversimplify, but the attributes of assets like gold and stocks are not dichotomous. Both the stock market and the gold space are extremely diverse. Even within each space, there are a variety of assets with different risk levels and expected returns.

For instance, many see the appeal of hedge funds – where stocks are actively traded to maximise short-term gains. While others prefer to invest in index funds that track the performance of indexes, like the S&P 500. In these two examples alone, the risk and potential returns vary greatly – even within the stock market.

Within the gold and precious metals space, some choose to invest in gold stocks. When investors purchase such stocks, they own some equity in a gold company; these stocks often move in tandem with the price of gold. As is the case with those who trade Gold ETFs, many attempt to reap the returns of the asset’s price fluctuations, while opening themselves to the risk of not owning the underlying physical asset.

The gold-backed crypto offering of Kinesis Gold (KAU) on the other hand, combines all the benefits of precious metals ownership with steady passive income in the form of a monthly yield paid in physical gold. When investors buy physical gold through Kinesis, they buy gold that is stored in Kinesis’ secure vaulting network, which is owned in the investor’s name.

Just by purchasing and holding said gold, investors can receive yield, as well as benefitting from the asset’s haven quality in a time of record high inflation rates, globally.

Is gold a better investment than stocks?

The decision to invest in gold or stocks ultimately depends on the priorities and risk tolerances of the individual investors. While investors with a high disposable income and a large appetite for risk, may prefer stock market investment, those seeking to minimise risk while recouping gains will likely prefer to choose gold.

In either case, some level of diversification could be wise. In the words of the hedge fund manager Ray Dalio, “diversifying well is the most important thing you need to do”. A diversified and nuanced portfolio may be the linchpin for investors to achieve their goals.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.