The recent Bitcoin crash provides an excellent opportunity to, yet again, bring to light the ever-growing comparison between cryptocurrency and gold.

But are those two currencies at all worth comparing, or is it a false debate? What distinguishes them, and is Bitcoin really the new “digital gold”?

When Bitcoin, the innovative digital currency, burst onto the scene in 2009, it set in motion a chain of events that fundamentally transformed the monetary landscape as we know it.

Cryptocurrency provided an excellent alternative to the traditional financial institutions that have long been struggling to keep pace with the forward-thinking mentality of Millennial investors. Yet, even the hitherto loyal generation of traders grew jaded over time and tired of the incumbent banking systems’ byzantine practices.

A New Hope

There has been a growing feeling that the current system doesn’t respond or cater to our expectations anymore. With the overall level of trust in the government on the wane, the confidence in the government-issued fiat currency has been subsequently lost. The value of the U.S. Dollar keeps constantly decreasing, as our economic & geopolitical system deconstructs itself. Bitcoin seemed like an ideal solution, capable of dethroning the present state of matters. It appeared to be a praiseworthy deliverer of the new financial reality, hastily appointed as a new ‘digital gold’, full of logarithmic grace and based on cutting-edge tech that embodied the progressive mindset.

By 2020, who hadn’t considered investing in Bitcoin? It appeared to be the ultimate get-rich-quick scheme, consequently breaking its own records at a record pace, continuously breaking new ground, reaching new heights as well as all the newspaper headlines.

To investors’ amazement, Bitcoin has tripled its value throughout 2020 and hit a spectacular $20K milestone in November, which has inspired incredible optimism in the crypto community. Subsequently, it has gathered even more attention from punters, who eagerly jumped on the Bitcoin bandwagon, contributing to its already skyrocketing growth.

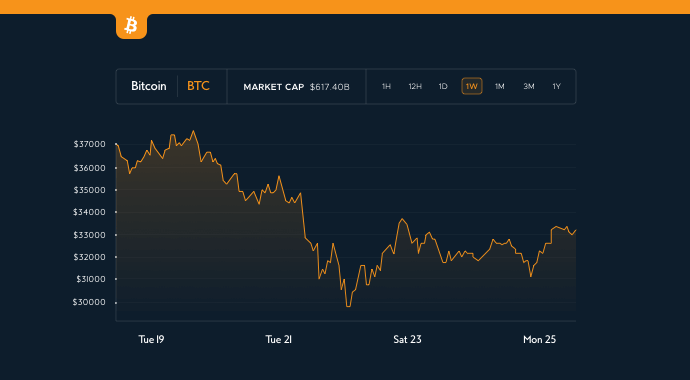

At the beginning of January 21, Bitcoin has doubled its value yet again, smashing through the $40K barrier. However, the jubilation was premature; it subsequently crashed down to below $30K within a couple of days, as if its moon-aiming engine suffered a combustion failure.

What Has Been Happening with Gold in the Meantime?

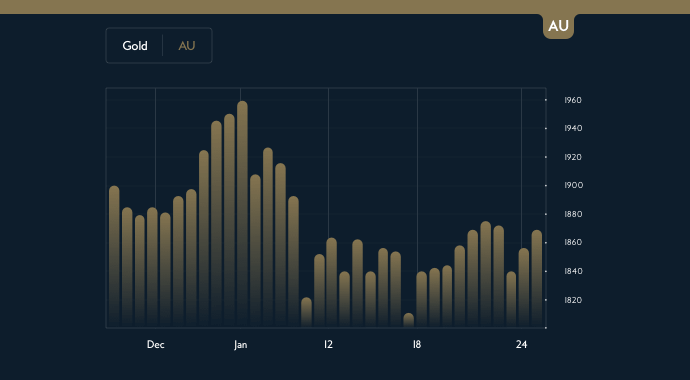

Let’s look at the chart.

Gold has dropped in value in a similar manner, falling from $1920 to $1870 between the 7th and 21st of January, losing roughly 3% of its value on its worst day. In the same period, Bitcoin had recorded a 25% loss, forcing a stampede of startled investors to get rid of their crypto, as it plunged dramatically.

The major distinction between these two assets is Bitcoin’s constituent proneness to extreme volatility, which could, in theory, make it an excellent vehicle for short-term investments. Simultaneously, its fickle nature renders it unreliable as a currency and turns remittances into a game of pay & pray. On the other hand, gold holds its unshakeable position as an ultimate safe haven, invariably functioning as a store of value and the most reliable currency since the beginning of money.

There is no competition between those two assets, as their underlying differences rule out the presumption of their rivalry. Does Bitcoin have the capability of becoming a digital successor of gold? Absolutely not; it lacks the precious metals’ inherent value and cultural heritage; it also fails to demonstrate stability and long-term credibility.

Forget Volatility and Protect your Capital

Bitcoin is ultimately an exciting trend, deprived of any intrinsic value that might stabilize it and enable it to establish a real-world utility status. Although appealing at first glance, it does not protect your capital in the long run. Instead, it fluctuates capriciously, governed solely by supply and demand, providing investors with high risk and dynamism, rather than a guaranteed profit or security.

Nonetheless, given the world’s economic turmoil, a tediously predictable asset would appear to be more desirable for most – an asset equipped with reliability as its principal trait. Precious metals are an uncompromised guarantee of stability, with gold consequently strengthening its value throughout history, steadily climbing, in disregard to the global crisis.

A False Debate

To conclude, it is ultimately a false equivalence to decide on a Gold versus Bitcoin superiority. These two assets are not comparable, as they demonstrate different functionalities, and it is investors’ individual choice to settle on the appropriate factors, determining their decisions in a financial market.

Although digital currency provides a utility for a global punting mechanism, it is gold that we can undoubtedly consider a real libertarian asset, comparably invulnerable to economic uncertainties. Investing in Bitcoin holds resemblance to gambling, while gold is the real-world asset you should park your money in if you aim for a long-term stable investment.

For an updated version of this discussion, see our Bitcoin vs. Gold article by leading market analyst, Carlo Alberto de Casa