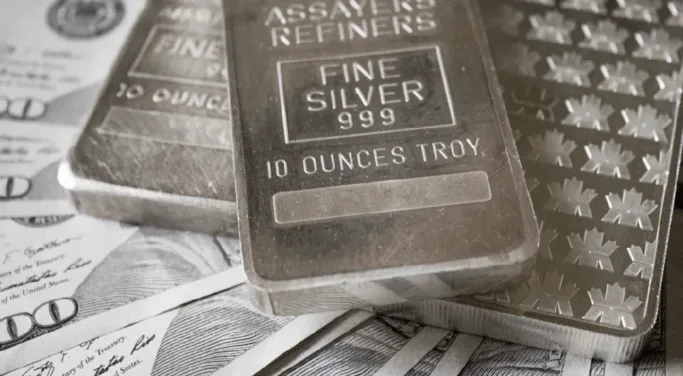

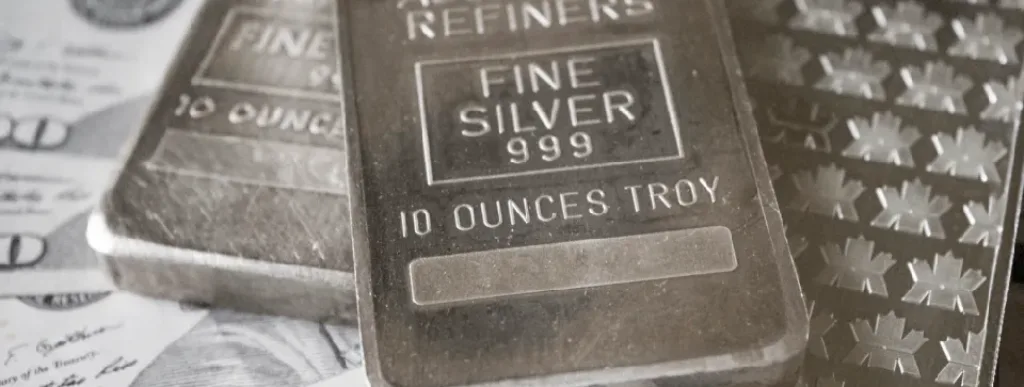

When compared with the torrid recent run gold is on, silver has shown itself to be surprisingly buoyant with the price holding above $19 an ounce despite central banks across the world being uniformly aggressive with their monetary policies.

Today sees the Federal Reserve announce its latest interest rate decision with a third consecutive 75 basis point increase the likeliest outcome. Given that it was the Fed’s switch to a much more hawkish stance that triggered silver’s multi-month price plunge in mid-April, the fact that silver is so far trading up on the day reflects that the price had sunk to levels way below its fundamental value with the prospect of many more rate hikes over the coming months priced in.

In contrast to gold, silver has made gains in September with the price making a tentative recovery after sinking to the lowest level in more than two years by the end of August. While clearly the prospect of another large rate hike by the Fed is a bearish short-term factor for silver, with its lack of yield making it less attractive when interest rates are rising, traders are continuing to see long-term value in a metal that will be a key commodity in the energy transition with its use in solar panels and batteries for electric vehicles.

The aggression of central banks means it is hard to see silver making huge gains with a stabilisation around $19 an ounce the best investors can realistically hope for in the short-term. However, while there is more optimism for silver than in recent months, a Fed that surprises with a 100 basis point hike would derail silver’s recent recovery and could see it swiftly plunge back to the year’s lows.

Rupert is a Market Analyst for Kinesis Money, responsible for updating the community with insights and analysis on the gold and silver markets. He brings with him a breadth of experience in writing about energy and commodities having worked as an oil markets reporter and then precious metals reporter during the seven years he worked at Bloomberg News.

As well as market analysis, Rupert writes longer-form thought leadership pieces on topics ranging from carbon markets, the growth of renewable energy and the challenges of avoiding greenwash while investing sustainably.

This publication is for informational purposes only and is not intended to be a solicitation, offering or recommendation of any security, commodity, derivative, investment management service or advisory service and is not commodity trading advice. This publication does not intend to provide investment, tax or legal advice on either a general or specific basis.