Kinesis Money Macroeconomic Analysis

In the last few months, investors have been used to seeing inflation data surpassing expectations and forecasts. Yesterday, the opposite happened with the U.S. Producer Price Index for December posting a modest increase of +0.2% – well below the expected +0.4%. Notably, food and energy, two key sectors in the 2021 inflation rally, showed a decline from November. These figures could see some investors believe that inflation pressure is starting to ease.

This scenario, in conjunction with a relatively dovish speech by Jerome Powell earlier this week, triggered a decline of the dollar. Indeed, the Dollar Index has fallen below 95 for the first time since mid-November. This has helped the precious metal sector with the gold price rebounding solidly, despite the 10 Year Treasury yields remaining well above the average of 2021 to about 1.70%-1.75%.

Kinesis Money Gold Analysis

Gold has started the new year showing significant resilience. The rebound seen in the last few days was certainly helped by the decline of the dollar, but we should consider that it happened while expectations for Fed rate hikes in 2022 jumped from 1 or 2 to 3 or 3.5. This all followed the December FOMC meeting and its hawkish meeting minutes, released earlier in January. Therefore, this positive movement should be considered significant.

From a technical point of view, the main levels to follow remain unchanged. Bullion is still being traded at around $1,825, with the first resistance just a few dollars above, in the region of $1,830-$1,832. A clear climb above this level could encourage more investors to buy gold, opening space for an extended rally, with a potential target of $1,870 – a level last reached in November 2021.

However, if gold doesn’t find the strength to break through $1,830, the price could continue its sideways dance between $1,800 and $1,830 seen in the last few days.

Indeed, the first support zone is placed at $1,800 but this doesn’t seem in sight for now. Of course, macroeconomic indicators (particularly inflation and secondarily labour data) and Treasury yields, remain the main catalyst to follow to understand the next steps for gold.

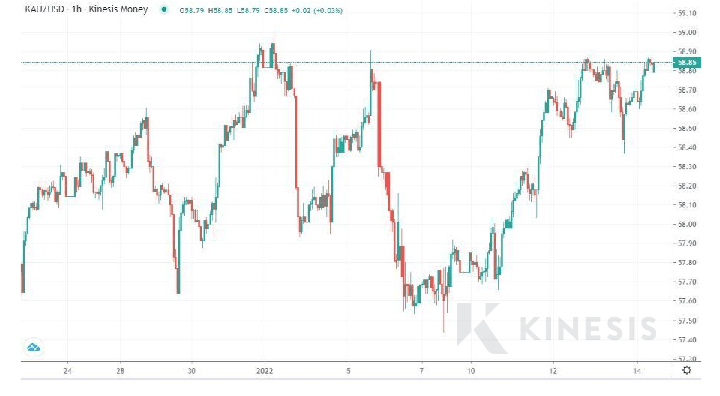

Looking at the price in dollars per gram, we can see that bullion is getting closer to $59 per gram.

Kinesis Money Silver Analysis

Silver seems to have forgotten – at least for the time being – the negative performance of 2021. Indeed, the precious metal is posting a gain of 4% from its price a week ago and is 8% above the level reached 30 days prior.

The short-term momentum remains positive, with the spot price trying to break through the resistance zone at $23.30 to continue its recovery to the next key levels of $23.45 and $23.68-$23.70. A successful challenge of both these levels can be seen as a proper inversion (and no longer as a rebound) for the silver price.

Find out more about what Kinesis has to offer

Carlo Alberto De Casa is an external Market Analyst for Kinesis Money.

He also writes as a technical analyst for the Italian newspaper La Stampa.

Carlo Alberto provides regular commentary for UK outlets including the BBC, Telegraph, the Independent Bloomberg & Reuters. He is also a commentator for CNBC Italy. He worked for Bloomberg as their Equity Research Fundamental Analyst before joining brokerage ActivTrades in 2011 to specialize in currency markets and commodities. In 2014 he published a book on gold and the gold market, followed by a new updated edition in 2018.

This report is not an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance.