Kinesis Money Macroeconomic Analysis

Today, the financial markets are clearly in a “risk-on” setting. In support of this outlook, last week saw the US stock market indices achieve a new all-time high, after the nonfarm payrolls beat expectations. This did well to solidify progress made towards economic recovery in the US.

Investors seem to have appreciated the dovish stance taken by the central banks of late. With the tapering process being largely expected, and now fully instigated, by the Federal Reserve, the proceeding response from the financial markets has been moderate. Furthermore, the Fed made some particularly dovish comments about interest rates, with movement set to remain close to zero until the end of 2022.

As for the Bank of England, they recently confirmed the base interest rate at a historical low of 0.10%. In this scenario, the prospect for gold and silver is positive, paving the way for an outlook that features significant gains for the precious metals.

In other words, not only has a new “taper tantrum” – like the one in 2013 – been avoided, but gold and silver have actually rebounded. On the other hand, the 10 Year Treasury yield has fallen below a return of 1.50% while stocks remain in the green zone.

Kinesis Money Gold Analysis

The gold chart speaks for itself. Bullion has regained its momentum, achieving its best week in over two months and closing Friday’s trading session above $1,815. All this happened, notably, just after the Federal Reserve announced a new tapering.

From a technical point of view, the scenario has improved. Even if buyers have not yet been able to push the price above the key $1,830 resistance zone, the gold price has already surpassed $1,813 – the high reached on the 22nd of October. It jumped up to $1,819, as investors were willing to further increase their exposure to the precious metal.

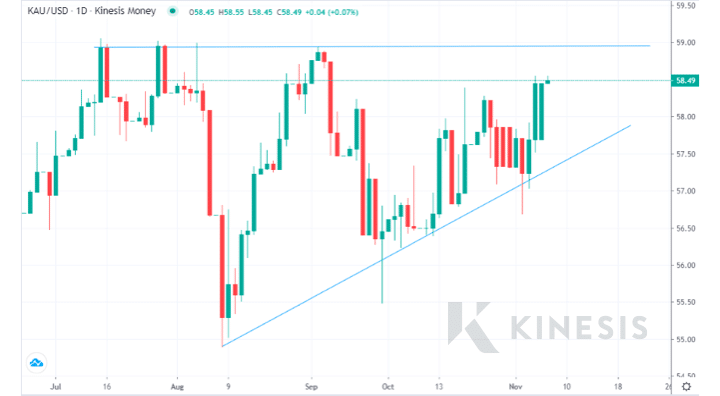

Now, bullion is close to the key resistance zone of $1,830 per ounce (or $58.8-59 per gram), which has already stopped gold rebounding three times in the last few months. Hence, a surpass of this threshold would open further space for new recoveries.

As observed in the chart – representing the gold price in dollars per gram – if bullion can surpass the obstacle represented by the resistance zone of $59 per gram, further recoveries can be expected.

Kinesis Money Silver Analysis

Silver has started the new week in a relatively steady position. Remember, it finished last week by jumping to $24.25, with the weekly performance up by 1.7%. This performance did little to shine a light on the future outlook for silver.

Last Wednesday, the low silver reached at $23.05 has since recovered by almost 5%. However, the recent high of $24.9 still remains to be the first main target for silver, while it finds an intermediate resistance zone at $23.67. If the price can exceed these levels, there could be space for new rallies.

Carlo Alberto De Casa is an external Market Analyst for Kinesis Money.

He also writes as a technical analyst for the Italian newspaper La Stampa.

Carlo Alberto provides regular commentary for UK outlets including the BBC, Telegraph, the Independent Bloomberg & Reuters. He is also a commentator for CNBC Italy. He worked for Bloomberg as their Equity Research Fundamental Analyst before joining brokerage ActivTrades in 2011 to specialize in currency markets and commodities. In 2014 he published a book on gold and the gold market, followed by a new updated edition in 2018.

This report is not an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance.