Peace talks between Russia and Ukraine remain extremely difficult and the conflict sadly continues. We have not seen any significant breakthrough in the negotiations in the last 48 hours and investors are looking for more clarity.

On the currency market, the Euro is trading just above 1.10 against the U.S. Dollar and investors are keeping a close eye on the Russian Ruble, after its remarkable move last week.

Following the sharp collapse seen in February and in the first few weeks of March, when the USD/RUB trading pair jumped to 130. The Russian currency changed direction, gaining 12.5% against the USD last week and returning to levels seen before the beginning of the war.

This was due to various factors, including Putin’s decision to demand rubles as a form of payment for Russia’s gas.

Further support for the ruble came from Putin’s attempt to stabilize the currency by imposing a temporary ‘gold standard’.

Indeed, Russia has fixed the exchange rate between its currency and gold at 5,000 rubles for 1 gram of gold, at least until the end of June 2022. Historically fixed rates have not proven to be a sustainable solution as they end up generating various other issues.

In this case, however, this new gold standard is helping Russia to stabilize the ruble, at least in the short term. But this is unlikely to be a long-term fix.

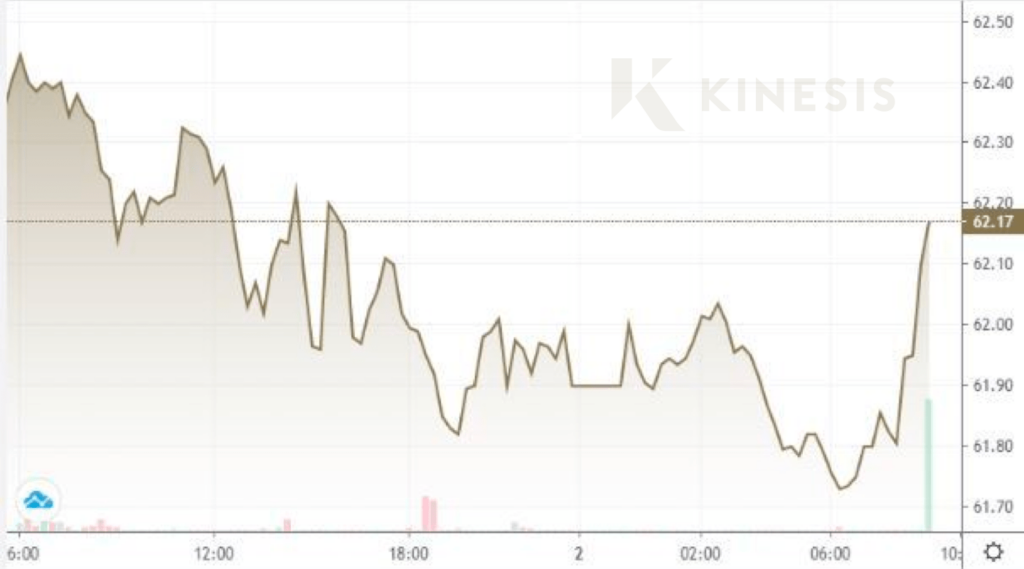

In the last few days, gold has traded in a lateral range between $1,900 and $1,950. Bullion has failed to surpass the resistance zone of $1,950 but has managed to remain above the support zone of $1,890-1,900 and the precious metal has started the new week moving laterally between $1,920 and $1,930.

From a technical point of view, a break above or below these levels would offer a first directional signal to investors.

On the macro front, the war in Ukraine is still one of the main market drivers, of course, but investors are also paying a lot of attention to inflation after the CPI jumped to 7.9% in the US and to 7.5% in Europe.

There is now a good chance that the Federal Reserve might hike rates by 50 basis points (from 0.50% to 1%) in May.

Find out more about what Kinesis has to offer

Carlo Alberto De Casa is an external Market Analyst for Kinesis Money.

He also writes as a technical analyst for the Italian newspaper La Stampa.

Carlo Alberto provides regular commentary for UK outlets including the BBC, Telegraph, the Independent Bloomberg & Reuters. He is also a commentator for CNBC Italy. He worked for Bloomberg as their Equity Research Fundamental Analyst before joining brokerage ActivTrades in 2011 to specialize in currency markets and commodities. In 2014 he published a book on gold and the gold market, followed by a new updated edition in 2018.

This report is not an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information. Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance.