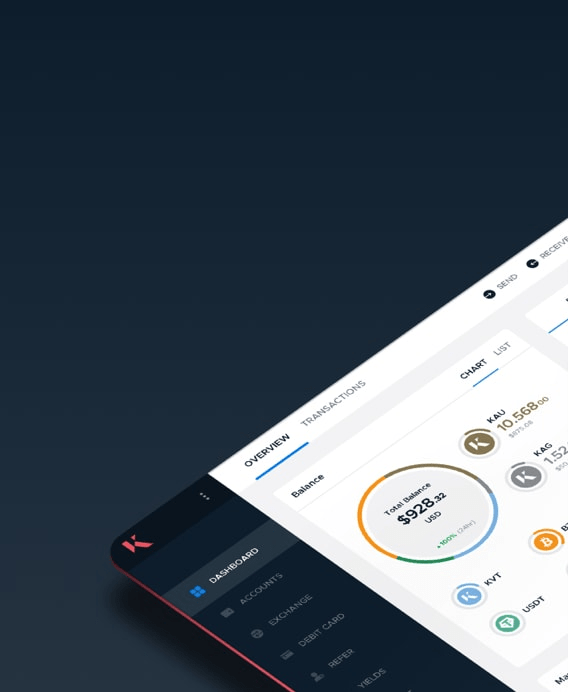

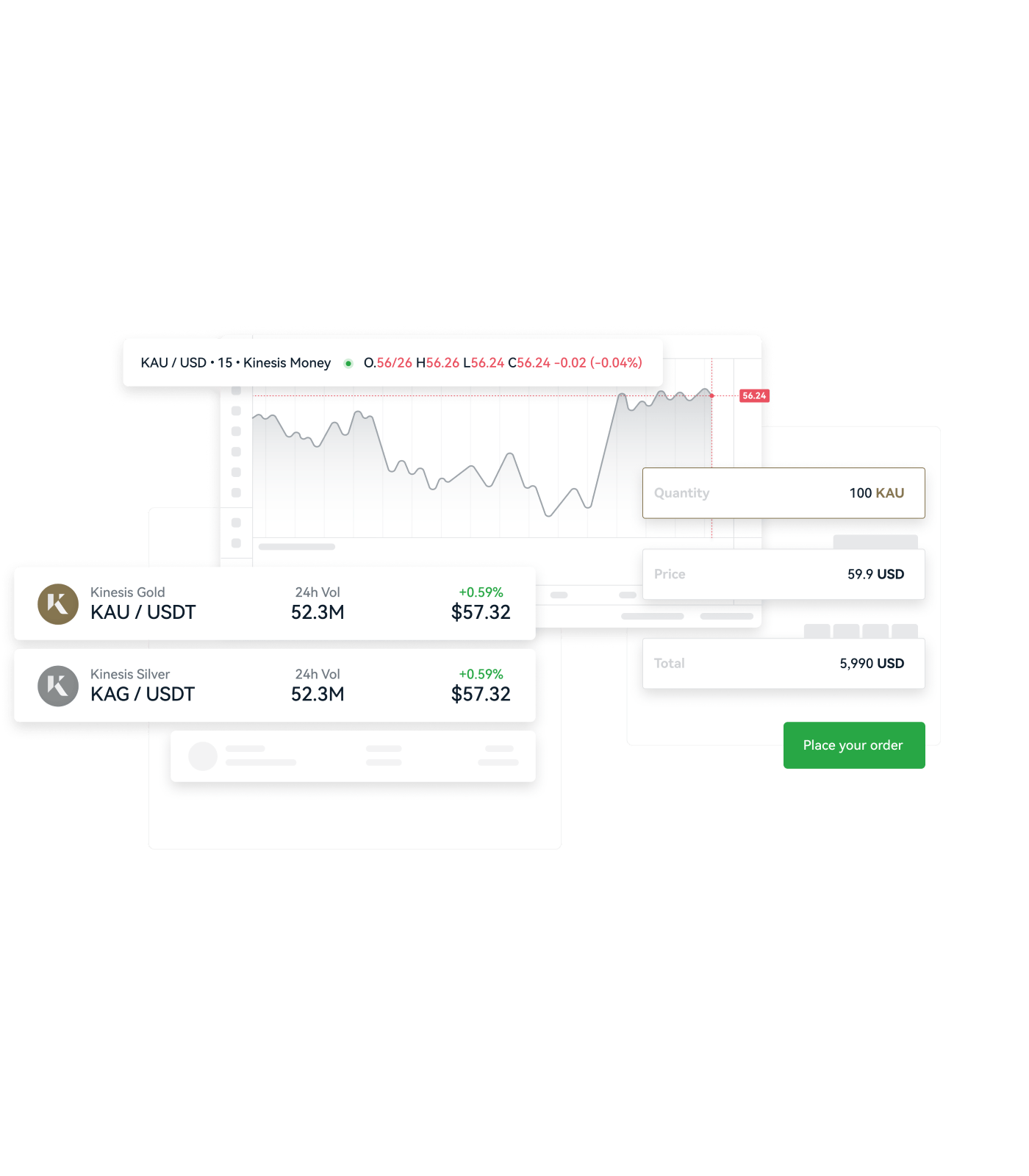

Kinesis Exchange

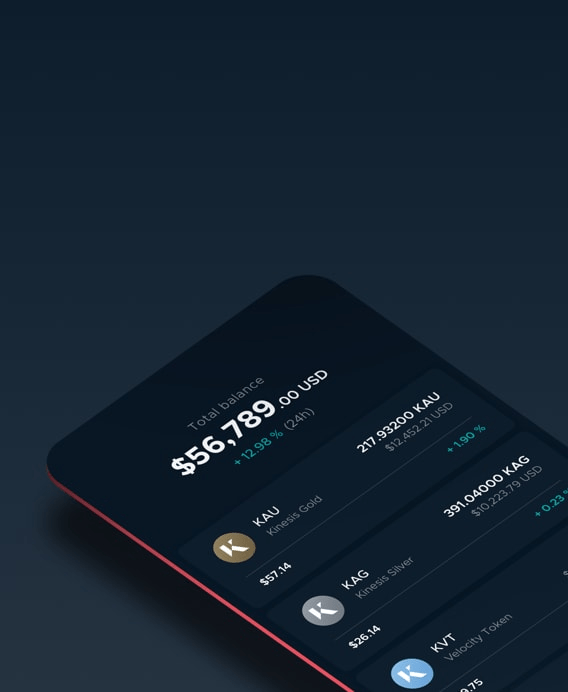

A powerful platform giving you the ability to instantly trade fully allocated physical gold and silver and cryptocurrency trading pairs.

Get more from your trading

Trade digitalised physical gold and silver, and leading cryptocurrencies, on a fast, intuitive platform, plugged into a thriving exchange ecosystem.

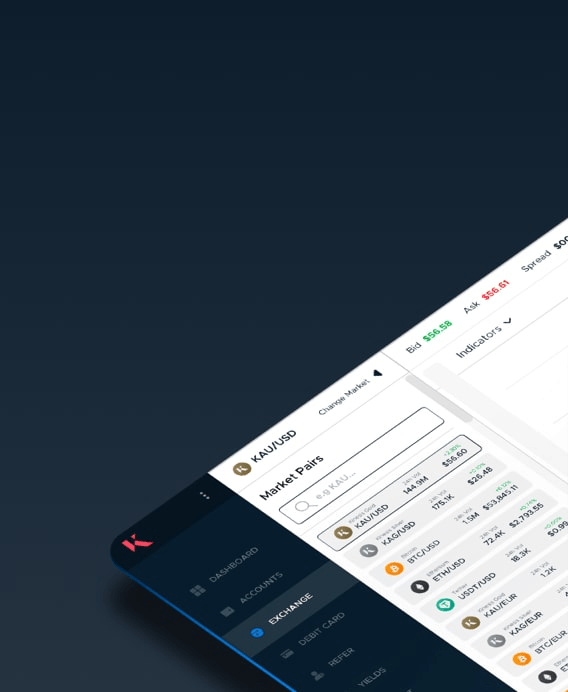

Trading made simple

A wide range of pairs

Lightning-fast execution on trade across 100+ available markets.

Pro charting

Clear, easy-to-use interface and ultra-responsive charting.

Trade automatically

Set limit orders to open or close at your chosen level.

Trade with confidence

10+ Years’ experience

Born from ABX, a leading global institutional physical precious metals exchange.

First-grade security

Secure servers, network segmentation, firewalls and cypher encrypted user data.

24/7 support

Our dedicated international support team is always available to help.